Pendle is currently a regular topic in the DeFi news. And that’s no wonder. For example, they allow you to trade in future yield. However, they also have another interesting feature.

That’s Pendle Earn. This makes yields easy and convenient. For instance, they offer Fixed Yield. So, let’s take a closer look at how you can boost your APY with this platform.

Introducing Pendle Earn pic.twitter.com/iYhHiqmA4l

— Pendle (@pendle_fi) July 18, 2023

What Is Pendle Earn?

Pendle Earn makes it easy to reap benefits from DeFi fixed-rates and yields. In general, it’s difficult to get your head around these DeFi strategies. Pendle Earn wants to change this. This product aims to make fixed rates and yields accessible to everyone. In other words, you don’t need to be a DeFi insider anymore who knows all the ins and outs.

Pendle Earn makes it a lot easier and more convenient to earn yield. It’s a straightforward and easy to understand feature. There’s no need nor room for technical explanations. This offers a few advantages, for example:

- It gives you piece of mind.

- You can get predictable returns.

- It’s possible to get higher yields.

Currently, you have various deposit options. Pending on the chain, you may have more options. Furthermore, you can choose between a fixed rate or add liquidity to a liquidity pool. Below you can find a chart with all the various rates or returns and chains. Currently, Pendle Earn operates on three chains: Ethereum, Arbitrum, and the BNB Chain. All the mentioned numbers represent their yield %:

| ETH fixed | ARB fixed | BNB fixed | ETH Pools | ARB pools | BNB pools | |

|

Frax |

4.87 |

13.5 |

||||

|

Lido |

4.27 | 3.76 | 12.2 |

16.6 |

||

|

Stargate |

3.81 | 3.13 | 12.3 |

12.2 |

||

|

GMX |

13.5 |

31.4 |

||||

|

Rocket Pool |

2.92 |

10.7 |

||||

|

Gains |

8.38 |

11.7 |

||||

| BNB | 3.2 |

18.5 |

This chart shows, for example, that Lido has a better fixed APY on Ethereum. However, the pool APY is much higher on Arbitrum. For Stargate, Ethereum beats Arbitrum on both counts. Be aware that all mentioned numbers can change. The picture below shows the current fixed yield rates on Ethereum.

Source: Pendle Earn Education

How Does Pendle Earn Work?

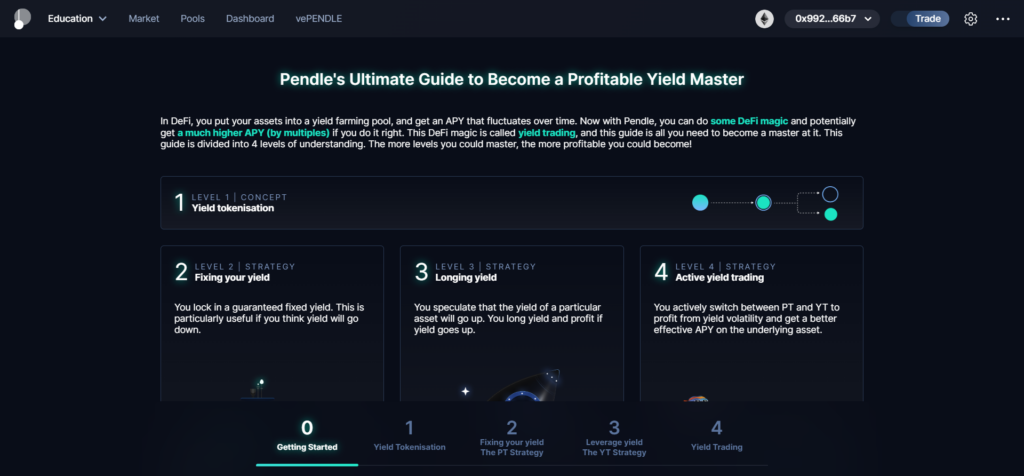

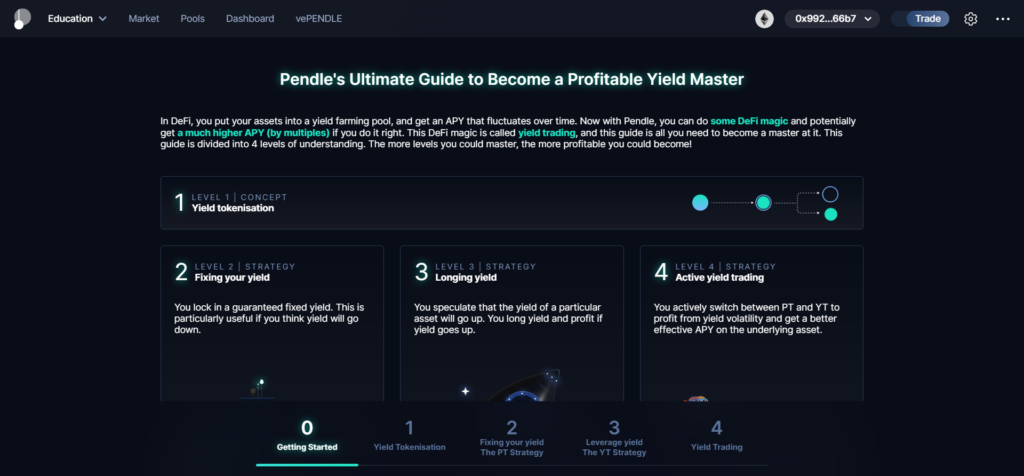

Pendle also offers an easy-to-follow guide on how to make the most out of Pendle Earn. This guide has 4 steps and aims at you becoming a profitable Yield Master. Usually, in DeFi, once you put your liquidity into a yield farming pool, the APY fluctuates.

With what Pendle calls ‘some DeFi magic’, you have the potential to get a higher APY. Pendle refers to this ‘magic’ as yield trading. That’s the essence of Pendle, trading in future yields.

Source: Pendle Earn Education

Pendle refers to the 4 steps as ‘4 levels of understanding’. Each level, you manage to master, gives you the option to become more profitable. So, here’s the explanation.

-

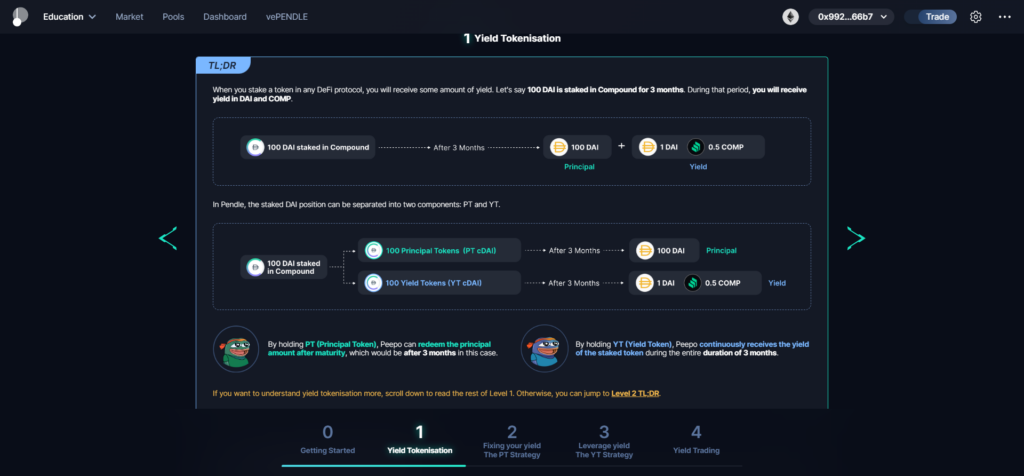

Level 1: The Concept

This is the yield tokenization. When you stake assets in DeFi protocols, you receive yield. Pendle uses a sample with 100 DAI staked in Compound over 3 months. This gives yield in DAI and COMP, respectively 1 DAI and 0.5 COMP. However, in Pendle, you split the staked DAI position up in two parts.

- 100 Principal Tokens or PT cDAI which after 3 months is 100 DAI.

- 100 Yield Tokens or YT cDAI which after 3 months is 1 DAI and 0.5 COMP.

Holding the PT tokens allows you to redeem the DAI after 3 months. However, holding the YT allows you to receive nonstop yield of the staked asset (DAI) over these 3 months. There’s an extensive explanation of PT and YT when you scroll down on the picture of the page below. Please click on the ‘source’ link.

Source: Pendle Earn Education

-

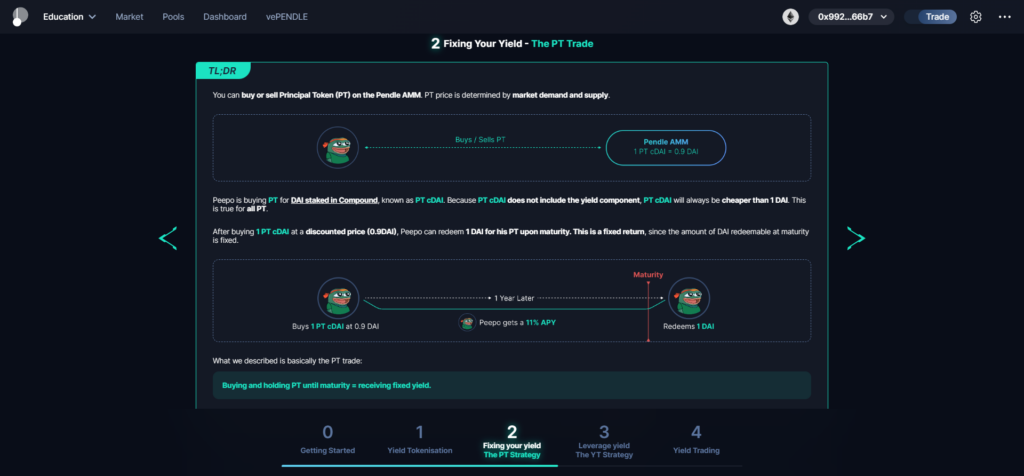

Level 2: Fixing Your Yield

In this part, you learn how you can buy or sell PT cDAI on the Pendle AMM. This is always at a cheaper rate of 0.9 DAI. That’s because the yield isn’t included. So, upon maturity, you can sell it for 1 DAI or 11% APY. There’s an extensive explanation available on this page. See the picture below.

Source: Pendle Earn Education

-

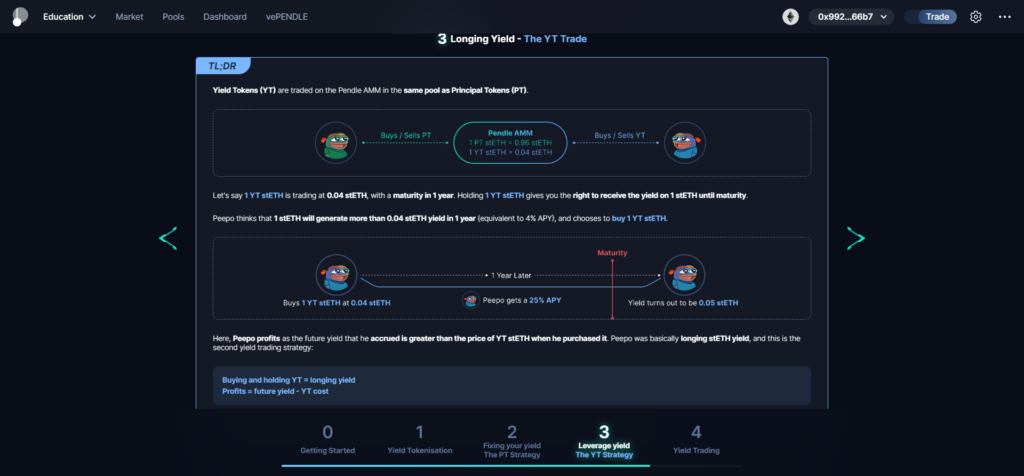

Level 3: Longing Yield

Part 3, Longing Yield, shows you how to long your position. This also comes with an extensive explanation on this page. See the picture below and click the ‘source’ link.

Source: Pendle Earn Education

-

Level 4: Yield Trading

In Part 4, Yield Trading, you learn the basics of swing trading. However, you also have the option to hold your position. This hedges your assets against both sides. Once more, this comes with an extensive explanation on the page. Click the ‘source‘ link under the picture below.

Source: Pendle Earn Education

Conclusion

In this article, we showed you four different ways of increasing your APY on Pendle Earn. We explained what Pendle Earn is and how it works. The article includes a comparison table. This table has the various APY percentages on the three available chains.

Pendle wants to make DeFi and how to maximize your yield easier to understand. However, be warned, it opens the door to the DeFi rabbit hole. Once you’re inside, there’s no way to turn back. Most likely, you will only go deeper into the hole.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.