Bitcoin has recently been on a tear recently. Over the last 30 days, it went up by 32.6%. Since Bitcoin is the crypto OG, most of the market followed suit. However, there are other ways to get involved with Bitcoin. Tectum offers these options in various ways.

So, let’s take a look at the news that’s cooking in the Tectum kitchen.

Tectum SoftNote Bill is here to restore the default anonymity essential for making Bitcoin payments!

This innovation was built on Tectum – the fastest blockchain in the world & it utilizes the application of zero-knowledge proof.

This method allows our users to initiate &… pic.twitter.com/myASQtITqN

— Tectum (@tectumsocial) November 15, 2023

SmarDex Increased Farming Pool Rewards

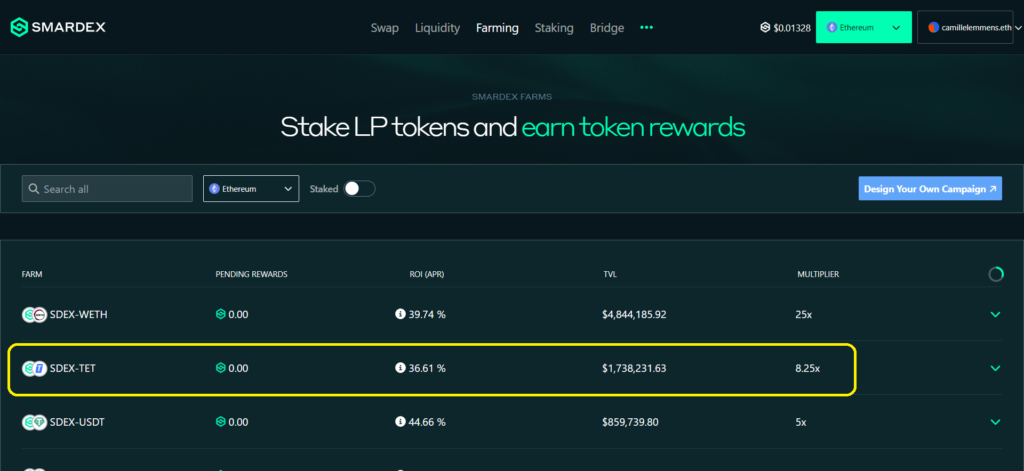

Tectum has its own TET token, and it’s an EVM token. For instance, on SmarDex, you can add it to the SDEX/TET liquidity pool. To clarify, SDEX is Smardex’s token. For up to 18 months, you will receive an APY of around 40%. Currently, the APY is at 36.65%.

SmarDex is a DEX that works using the AMM model. It’s available on five different chains. For instance,

- Ethereum.

- Binance Smart Chain.

- Polygon.

- Arbitrum.

- Base.

One unique feature of this DEX is their view on Impermanent Loss (IL). They have a technology where they can get impermanent gains instead of IL. You can look this up in their docs or whitepaper. The picture below shows their APY in the SDEX/TET pool.

Source: SmarDex

BTC Ordinals on SoftNote

One of Tectum’s flagship products is their SoftNote. This is a transactionless payment system. It offers instant BTC payment without fees. However, Tectum now took it one step further. They launched an Ordinal division. In other words, you can transact Bitcoin Ordinals now on a SoftNote. Here’s a link to our introductory article about Tectum and SoftNote.

This avoids the high BTC fees and there’s no clogging up of the mempool. The clogging up turned into a serious issue when Ordinals became popular. So, the bitcoin maxis should be happy with this development. Furthermore, the Tectum Bitcoin Ordinals NFTs are now walletless. More on that below. The Tectum SoftNote Ordinals have a few unique features. For example,

- You can’t reinscribe a SoftNote Ordinal. In other words, they are immutable. This contrasts with traditional Ordinals.

- The Tectum Ordinal NFT files can store and mint up to 2 GB. Instead of minting on Bitcoin, they mint on their Tectum blockchain. Minting on Bitcoin restricts images and files by the block size and fees of Bitcoin.

- Transactions take place on the Tectum blockchain. As a result, they don’t overburden the BTC mempool.

- The SoftNote Ordinals don’t need a Bitcoin wallet. Instead, they use a serial number and passcode to transact. This opens up plenty of other options, including platforms like Discord or WhatsApp. You can even send them by email.

Bitcoin Softnote Ordinals!

Here’s a sneak peak into Tectums upcoming Ordinal smart contracts:

🔹 Transaction speed/cost

BTC: 2 hours/$11

BTCsn: instant/$0.02🔹 1MB Inscription fee:

BTC: $8000

BTCsn: $1.96🔹 Function:

BTC: Wallet-Wallet, Reinscribable

BTCsn:… pic.twitter.com/ocIcPe5x43— Tectum (@tectumsocial) November 12, 2023

TET Token Listed on LDX

The TET token has a new listing. You can now find TET on the LDX exchange. This listing started on 24th October 2023. As a source chain, use Ethereum. It’s a cross-chain swap and bridging platform. Carbon Browser powers this exchange.

Currently, LDX, which stands for Liquid Decentralized Exchange, has 18 chains on offer. This includes all major EVM compatible chains, like, Ethereum, Arbitrum, Optimism, or BSC.

New DEX Listing!

As the first stage of our partnership with carbon browser we stated that they would be lIsting $TET on their DEX @LDXFi

This listing is now live!

Trade here: https://t.co/DAgb6NG1Xo pic.twitter.com/8WRdMYAWHD

— Tectum (@tectumsocial) October 24, 2023

Bitcoin Spot ETFs

At this very moment, there are 12 Bitcoin spot ETFs waiting for approval by the SEC. This approval seems imminent. Part of the current BTC price action is because of these BTC spot ETFs. As a result, anticipation is high, and it could give the BTC price an entirely new impulse.

However, only a single BTC spot ETF approval could cause an overload for the Bitcoin mempool. In case this happens, we need a scaling solution. Tectum’s SoftNote is, in fact, one of the biggest Bitcoin scaling solutions. So, if you buy some TET tokens, you can join the SoftNote ecosystem.

This allows you to send Bitcoin to anyone. For example, send it to any of your friends. You can also use it to pay for simple things like coffee. SoftNotes have instant transactions and they can be 100% anonymous.

Huge ETF Development!

The SEC is currently evaluating 12 Bitcoin ETF applications!

If even one gets approved the Bitcoin mempool will overload and a scaling solution will be essential

Buy $TET and enter the ecosystem of the biggest bitcoin scaling solution in the world-… pic.twitter.com/c8RGwjuk4l

— Tectum (@tectumsocial) November 9, 2023

Conclusion

Tectum and its SoftNote keep developing and growing. We gathered some of their latest news developments which we covered in this article. This included, among others, a high APY on the SDEC/TET pool on SDex, BTC Ordinals on SoftNote, a new TET listing on LDX. Not to forget use cases for SoftNote in case the BTC spot ETF gets approved.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Tectum.

Copyright Altcoin Buzz Pte Ltd.