Blockchains can’t talk to each other. That’s why we need bridges, to transfer assets and messages between them. Wanchain is an OG bridge, they’ve been around since 2018. During that time, they never experienced a hack.

So, the Wanchain team is also busy and keeps building. Time for a recap on Wanchain’s latest updates.

📢 Wanchain interoperability solutions, including WanBridge and XFlows, now support native #USDC issued by @circle on #Polygon.

💡 The $USDC address on @0xPolygon is 0x3c499c542cef5e3811e1192ce70d8cc03d5c3359. This replaces the Polygon Bridge-wrapped USDC, now called USDC.e. pic.twitter.com/6bwDDwEBxs

— Wanchain (@wanchain_org) December 13, 2023

Wanchain Debuts Huge Bitcoin Bridge Upgrade

Since 28th November, Wanchain has full Taproot support in place. Among other things, this improves security and scalability. Taproot aims to make Bitcoin not only faster, but also more private and efficient. So, next time you want to complete a cross-chain transfer, it’s more secure, efficient, and flexible. At the same time, you don’t lose any decentralization aspect.

Wanchain keeps updating its bridge with state-of-the-art features. This includes a uniMPC. That’s a unified MPC or unified multi-party computation. MPC upgrades privacy for one thing. It requires fewer upgrades for their bridge nodes. As a result, it reduces operational resources. More details are in their blog.

The industry’s best #Bitcoin Bridge just got better!

✅ Full Taproot support

✅ uniMPC📚 Learn how #Wanchain‘s latest Bitcoin Bridge upgrade bolsters security, increases privacy, improves efficiency and reduces costs: https://t.co/bYjdEWUbU0#XFlows #WeAreAllConnected

— Wanchain (@wanchain_org) November 28, 2023

Bridging to and From Cardano with Wanchain

Bridging to and from Cardano is not an easy task. This makes Wanchain the only decentralized bridge that offers this. It took Wanchain no less than one year to build this bridge. To clarify, Cardano is not an EVM chain. In other words, this was a real feat for the team. It allows you to move 7 assets between 11 routes. The 7 assets are BTC, ETH, ADA, USDT, USDC, DAI, and WAN. Here’s a link to their bridge and a link to our article about this bridge. See the picture below for the routes and assets.

Source: X

New Partnerships With Maestro and Cherry Lend

Partnerships are an important feature of projects. They can complement each other and be beneficial for both parties. Wanchain recently partnered with two new protocols.

- Maestro — they are joining forces to bridge Cardano and Metamask. This will improve interoperability. As already mentioned, this is the only decentralized Cardano bridge.

- Cherry Lend — This is a lending and borrowing protocol on Cardano. They added lending and borrowing for USDT, BTC, ETH, and USDC. You will earn the CHRY token as a reward. Wanchain provides a bridge for this.

#Wanchain & @GoMaestroOrg are joining forces to bridge #Cardano and @MetaMask!

💡 This solution will allow users to interact with any Cardano Dapp using Metamask.

Check out the proposal and leave your feedback!

🗳️ https://t.co/pjq9mDalWj#CardanoCommunity #WeAreAllConnected pic.twitter.com/kacp39iAn9

— Wanchain (@wanchain_org) December 8, 2023

Other Bridge News

There are also some exciting news updates and new bridge options available. So, let’s take a look,

- Between Arbitrum to Polygon — You can go through a CEX. However, this requires KYC, and it’s custodial. With the Wanchain bridge option, you can use XFlows. A decentralized and noncustodial option. In other words, at all times, you have custody over your assets. You don’t have to ask a CEX to return your tokens. And more importantly, you don’t have to bridge to Ethereum and back. You can go direct which is faster and cheaper.

- Between Astar Network and Polygon — You receive as much as you send. The bridging fee is 0.46 ASTR. That’s about $0.04 at current rates. Fees on Astar are another 0.27 ASTR or $0.02.

- Wanchain powers the new Bitrock bridge. — You can now move their USDB stablecoin around with the new bridge. The bridging fee is 0.5% both ways.

- VinuChain bridge — This is an EVM compatible DAG chain. It has high scalability and no fees. DAG or Directed Acyclic Graph doesn’t record transactions in blocks, like a blockchain. It uses verticals instead, that build on each other. However, it does use nodes to route the transactions, like a blockchain.

- Transfer the LOUEY token between Cardano and BNB chain.

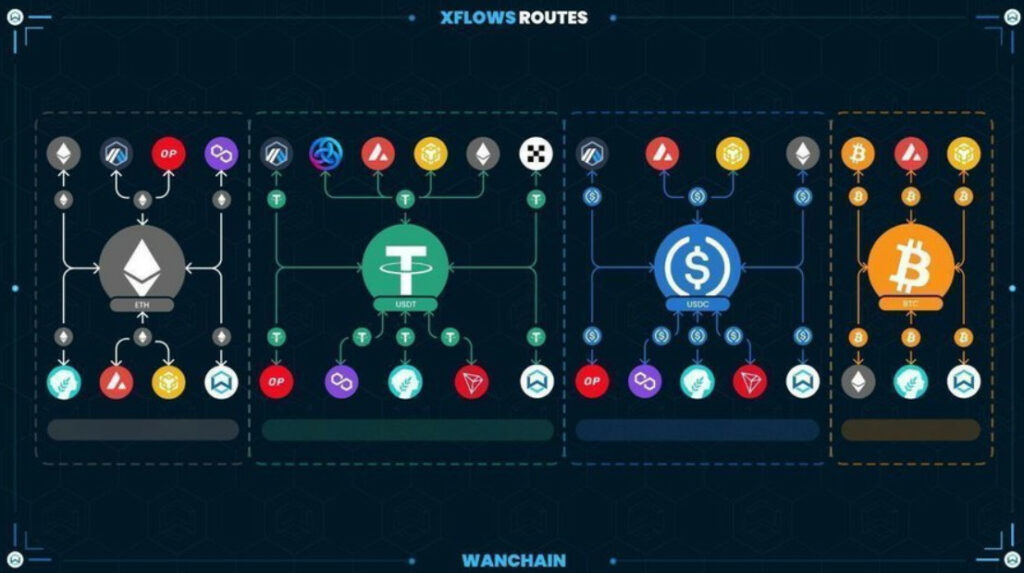

The following picture shows the XFlows routes.

Source: X

Wanlend and Assorted Stats

Wanlend maintains favorable APR rates for stablecoins. For example,

- wanUSDC 14.35%

- wanUSDT 13.66%

They now also have decreased WAN token emission rates, by as much as 25%. This is following their tokenomics schedule.

In cross-chain volume, Wanchain reached another milestone. It hit $700 million and counting. The next target is to reach $800 million and eventually $1 billion.

The platform with all its bridges has been up and running for 5 years and 327 days, as of 8th December 2023. The highest transaction of the week was between the Tron and the BNB chains. Somebody moved $120,929.93 USDC around. Total fees for that transaction were 24 Tron or $2.40 at current rates. However, the most bridged asset was USDT during that week.

Hello Wanlenders,

Giving a quick update to the community to share that the $WAND emission rate has now decreased by 25% according to decreasing scheduled.

Please stay tuned for more updates regarding the operations of the protocol such as next burning of $WAND @wanchain_org pic.twitter.com/0E9OJgDEAn

— WanLend (@WanLend) August 17, 2023

Conclusion

The Wanchain platform has been offering bridging services since 2018. Since that time, it hasn’t experienced a single hack. In contrast, the team always kept building. As a result, more bridges are now available to use. This article highlights recent news from the team and its bridges.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Wanchain.

Copyright Altcoin Buzz Pte Ltd.