For several decades, fiat and gold-pegged currencies served as the foundation of the world’s economy. But these have shifted over the years. There’s now an alternative financial system. It’s decentralized finance fueled by Bitcoin and other cryptos. But how did we get here?

Very few dates are as significant in US economic history as August 15th, 1971. President Richard Nixon ended the Bretton Woods agreement. He announced on national TV that the US would no longer redeem dollars for gold presented by foreign central banks. This had many implications for the world’s economy. It also paved the way for crypto, as we have it today.

Consequences

We can trace many other events in history to 1971. The US decision to cut off the link with gold sent shockwaves through the decades. It marked the beginning of the euro. It also sparked the demise of US manufacturing. And the power of central banks to generate virtually endless amounts of money.

Nixon argued that deciding to shut the gold “window” was only temporary. But that was far from reality. It was similar to Britain’s move to sever the pound’s ties to gold in August 1931. That was four decades before Nixon’s big news. 1971 was the final straw for the traditional gold standard of the 19th century.

A Little Background Story

Life after World War II began with a new negotiated monetary system. This system established the guidelines for global economic and financial relationships. The Bretton Woods Agreement of 1944 was one of the most significant determinants of the world’s economy post-WWII.

Source: wtfhappenedin1971

The event was held before the end of the war in New Hampshire. It set up some of the trade pillars of that era. This includes the International Monetary Fund (IMF). And the International Bank for Reconstruction and Development (IBRD).

Many of the governments supporting the Bretton Woods system hoped the system would prevent another bloody global war. The main strategy was to establish a strong global monetary system and lower trade restrictions.

Source: wtfhappenedin1971

Participants resolved that the U.S. dollar should serve as the foundation of their monetary system. The dollar was linked to gold at a fixed price in an effort to mimic the pre-war gold standard, albeit in a limited way.

So, the American government promised to exchange dollars for gold at a price of $35 per ounce. The U.S. dollar replaced real gold as the new gold standard. It however maintained some degree of flexibility.

As a result, the US government faced problems backing the dollar with gold. The US had already printed too much money to fund the Vietnam War and other welfare programs in the 1960s. This led Nixon to draw the curtain on the system.

How Effective Was the Bretton Woods System?

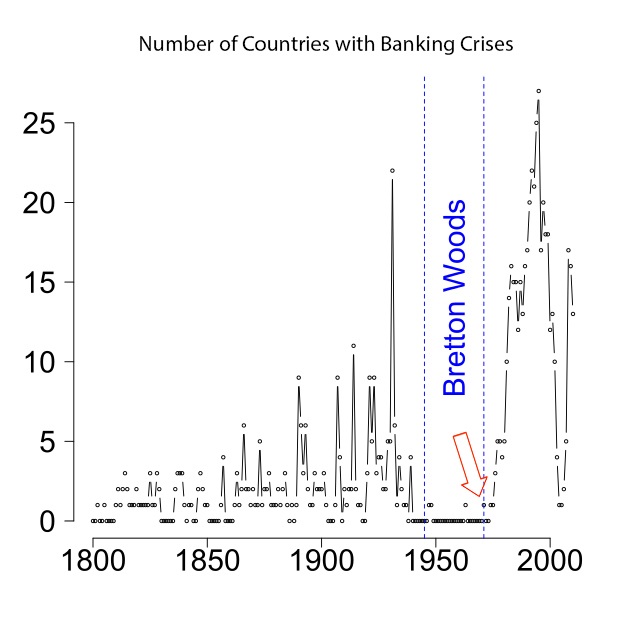

The Bretton Woods system was pretty effective. It provided the post-war world with the stability it needed for a while to recover and restore itself. Almost no major country went through a banking crisis between 1945 and 1971 when the agreement was upheld.

Source: wtfhappenedin1971

Furthermore, the system significantly reduced speculative financial flows. And investment resources were instead directed into advancing industry and technology. The system gave peace greater opportunity. It also fostered national economic growth, generated jobs, and removed barriers to trade.

So, What Happened in 1971?

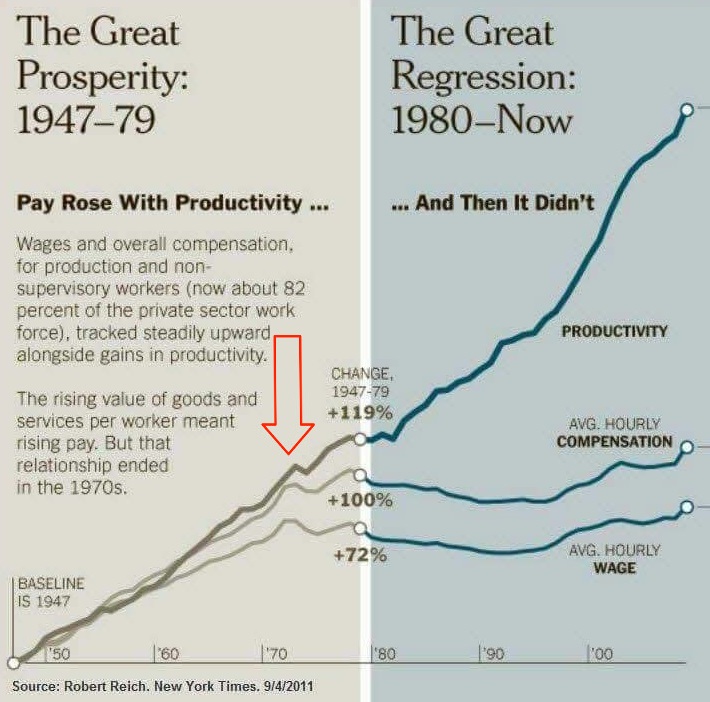

A website called “WTF Happened in 1971?” paints a near-perfect picture of how 1971 ruined the world. It presents detailed data to explain some of the significant results of the Bretton Woods agreement. Prior to Nixon’s decision to end the dollar-gold arrangement, productivity surged sharply, and wages, unlike now, did not lag.

The narrative displays some graphs. This graph illustrates how, starting in 1971, productivity rose while wages stagnated. It also showed that the GDP increased but the workers’ share fell. And house prices skyrocketed, making Americans’ savings indissolubly linked to property values.

Source: wtfhappenedin1971

The narrative implies that currency crashes, banking crises, and hyperinflation increased globally. Personal savings rates plummeted. Furthermore, incarceration rates surged fivefold. Divorce rates skyrocketed. And the proportion of people in their late 20s still living with their parents rose dramatically.

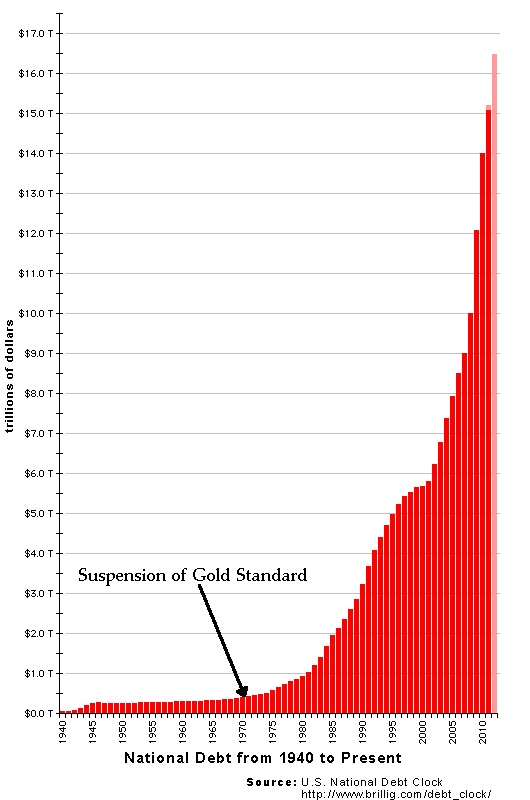

There are other unfavorable developments since the end of the last gold standard. One of them is the growing national debt of the United States. It increased from well below a trillion dollars in the 1970s to over $20 trillion in 2018.

Source: wtfhappenedin1971

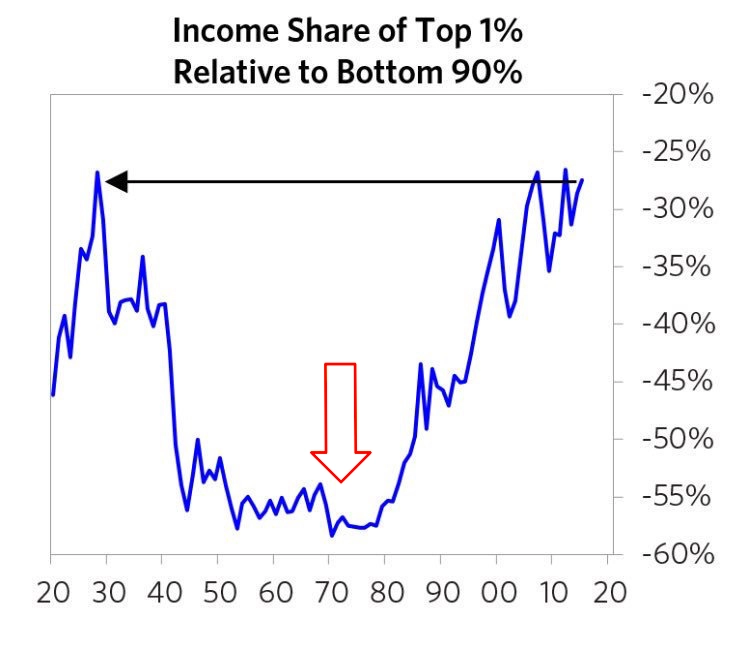

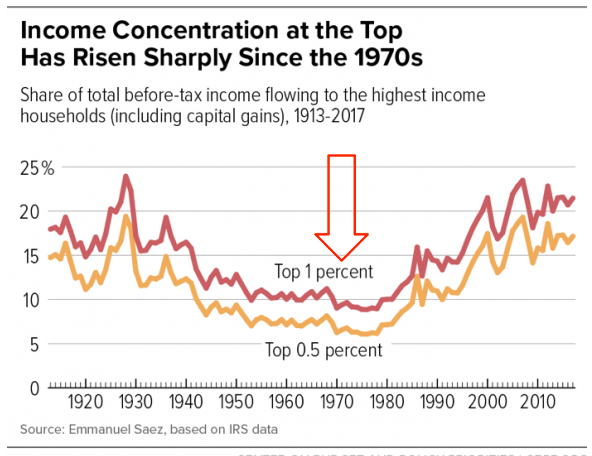

The dollar-gold standard reduced income inequality in the US. Income inequality has been a huge problem in the US since the establishment of the Federal Reserve System in 1913. It also increased once again after 1971. The income of the top 1% of earners has increased dramatically since 1971.

Source: wtfhappenedin1971

Unfortunately, that of the bottom 90% has remained essentially constant. So, the rich have continued to get richer, while the poor have had little change of fortune.

Source: wtfhappenedin1971

What Other Factors Led to the Launch of Bitcoin?

The 1971 policy changed global finance. It also ushered in a new era of economic difficulty, as shown earlier. But that wasn’t the final nail in the coffin. That was the 2008 global crisis. The 2008 financial crisis planted a general distrust in the banking sector.

Bitcoin launched in 2008 as people sought alternatives to the current financial system. People wanted a substitute for banks and conventional currencies. So, the financial world relied heavily on banks as intermediaries for all kinds of transactions. This was a huge problem.

Bitcoin differed from traditional finance. It also promised to level the playing field. Bitcoin’s creator, Satoshi Nakamoto, came up with the idea of developing a peer-to-peer payment system without the need for external verification.

The idea was to eliminate banks from financial transactions. So, it was unnecessary for the banks to get involved in every transaction. Banks had been politicized. So it was easy to target people. But with Bitcoin, everyone has access to financial services. Cross-border transactions became easier.

In the tweet below we can see the magnitude of the consequences of the 2008 crisis vs. this year’s by comparing the banks that were in bankruptcy. One is definitely bigger than the other.

Source: Twitter

Conclusions

The events of 1971 and 2008 have shown that there is a need for a reserve currency independent of government control. Such a currency is preferable to fiat money. Fiat is subject to the interests of one powerhouse or another.

So, decentralized cryptocurrencies are the world’s best bet at achieving this. Cryptocurrencies, such as Bitcoin, act as a medium of exchange and a store of value in a non-custodial way. Interestingly, Bitcoin cannot be inflated or deflated by politically biased decisions. Instead, it is a tool that promotes cross-border commerce. And financial activities without taking sides. Additionally, participants own the actual asset rather than a derivative.

We’ve seen governments make decisions in their own interests that affect the status quo. But Satoshi Nakamoto seems to have factored in history when designing the fundamentals of Bitcoin. In the end, it is safe to conclude that the financial system propelled by Bitcoin provides the solution to the problems of 1971 and 2008. The idea is to channel control back to the regular person. Your financial future no longer has to be subject to a political party or some decree.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.