In the previous article, we talked about two very popular Binance products, Launchpool and Vault. In this article, we will cover the remaining offerings under Binance Earn, namely, Fixed Terms and High-Risk Products.

Table of Contents

Fixed Terms

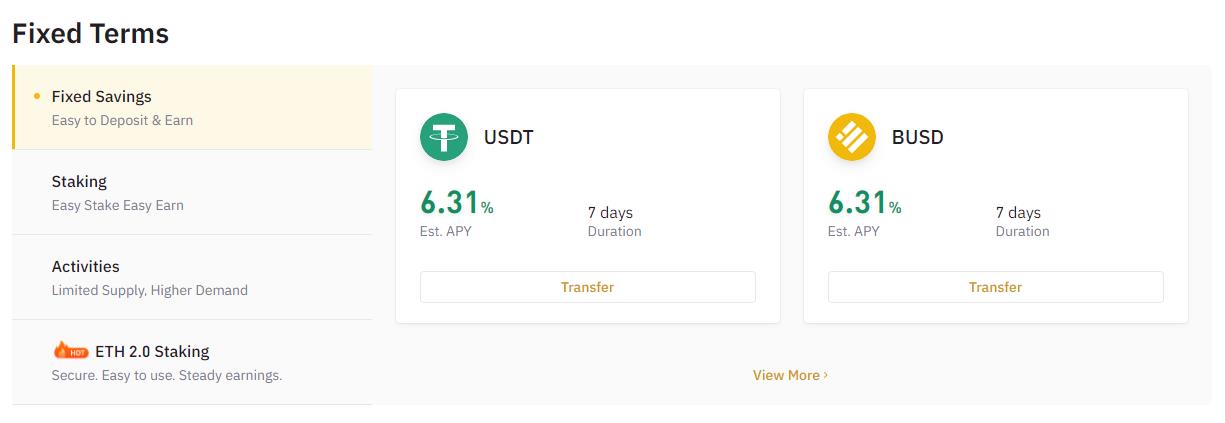

This product requires the users to deposit the crypto asset for a certain period. Fixed Savings offers a slightly higher interest rate.

You can see four different products under Fixed Terms:

- Fixed Savings

- Staking

- Activities

- Eth 2.0 Staking

Fixed Savings

When you subscribe for fixed savings, the funds are deducted from your exchange wallet. On the value date, Binance Savings will distribute the Locked Savings product to your savings wallet, and your saving product will start to accrue interest. On the redemption or maturity date, you can see both the tokens and the earned interest in your Binance account Balances field. This process will be automatic.

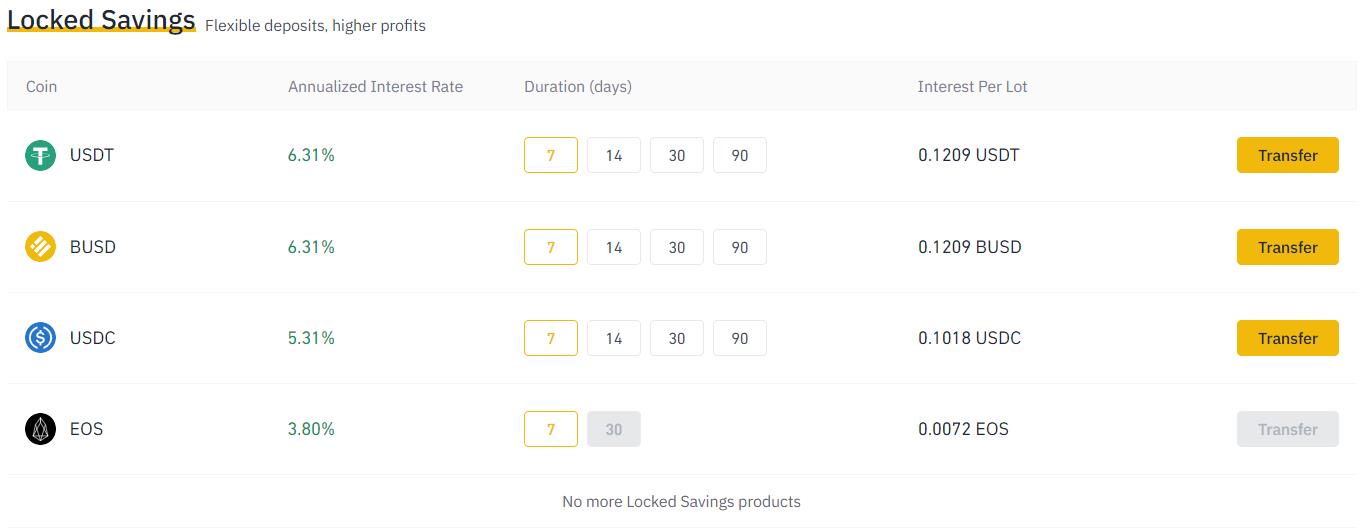

Binance currently offers three different tokens under locked saving schemes. It lists the annual interest earned by individual tokens and a flexible duration (in days) which users can choose as their lock-in period for assets.

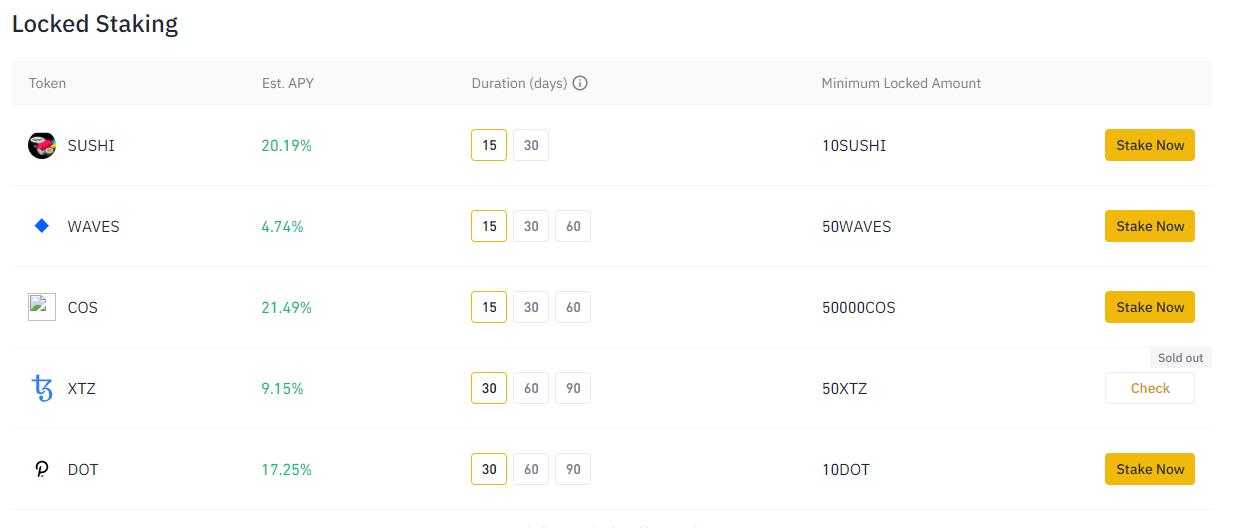

Staking

The staking program allows you to stake on particular coins with a few simple steps. You do not need to go to the individual crypto platforms and learn the staking process. However, note that the staking reward will be decided by Binance based on the actual on-chain staking rewards. Also, you will not hold the keys. Staking can be done for 15, 30, 60, or 90 days.

Binance currently offers 27 products under locked staking. As the name implies, in locked staking, the asset will be locked for a certain period. Users can select the duration depending upon their convenience.

You can check the following criteria before locking the asset:

- Estimated APY

- Duration

- Minimum and maximum locked amount

- Redemption period

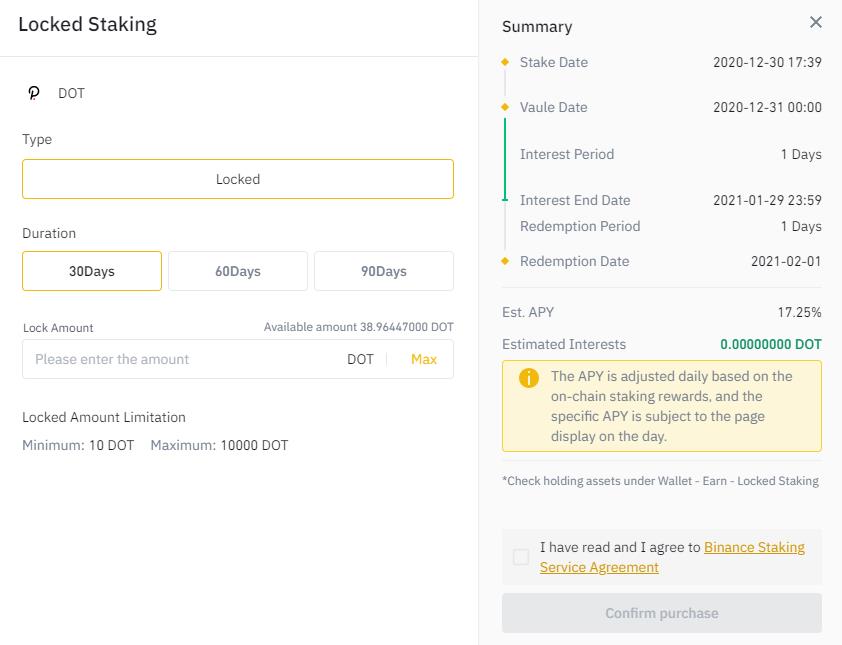

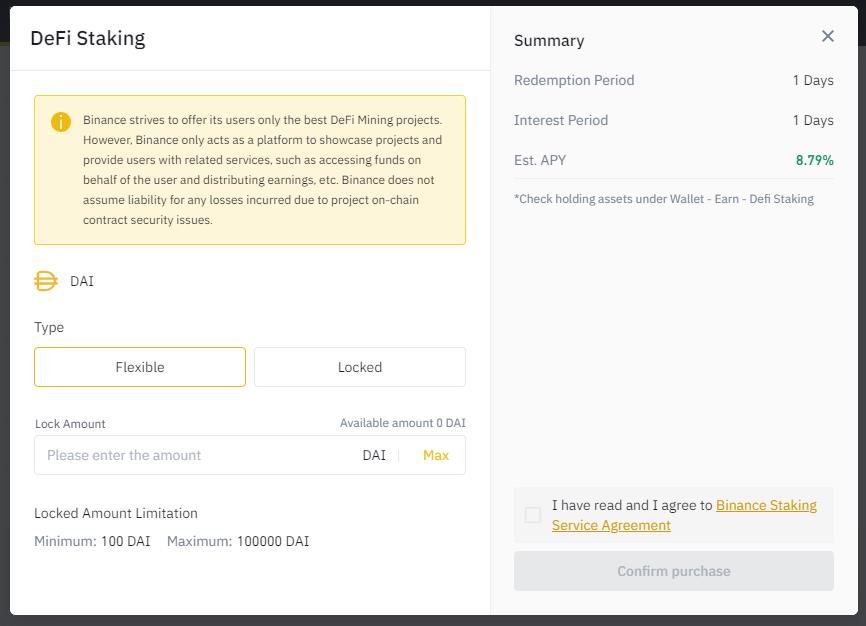

Click on Stake Now.

Select the duration, amount, accept the terms and conditions, and Confirm the purchase.

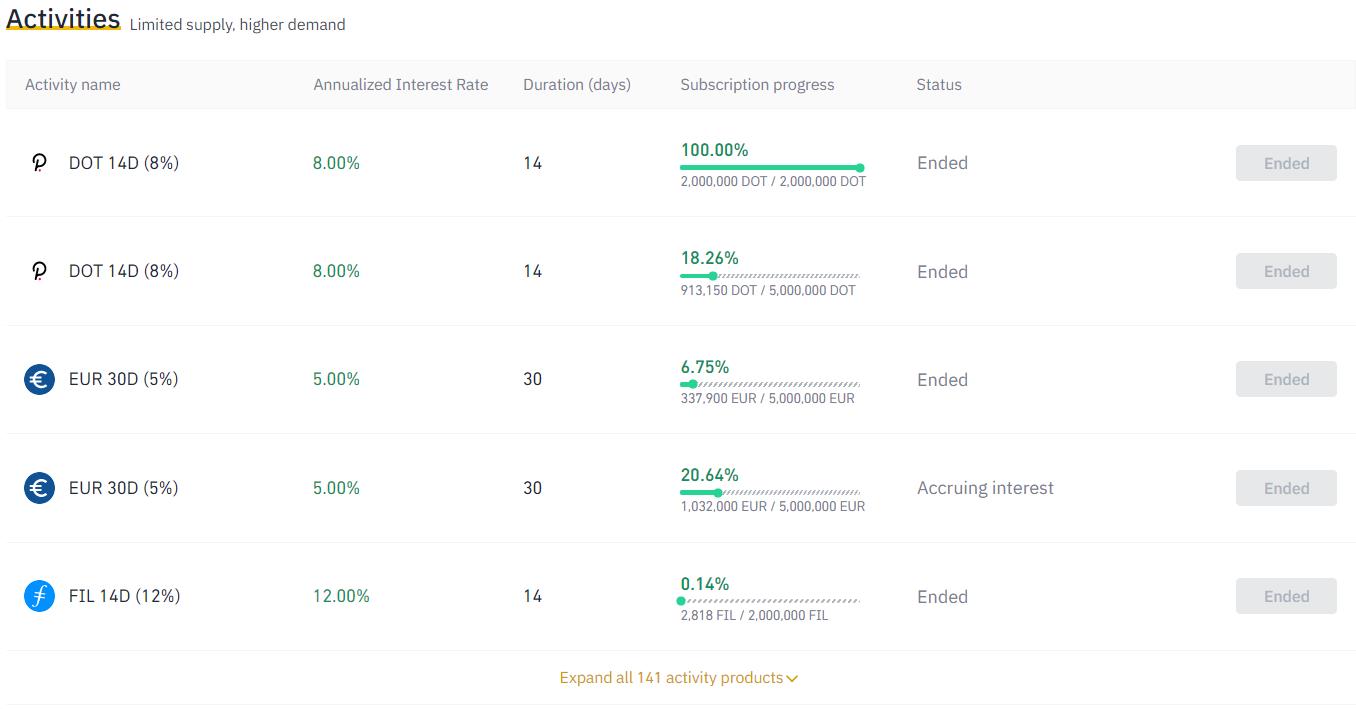

Activities (Locked Savings)

Activities have a limited supply. They give high interest. Once the subscription supply is locked, the system closes the product and provides interest only to the locked assets.

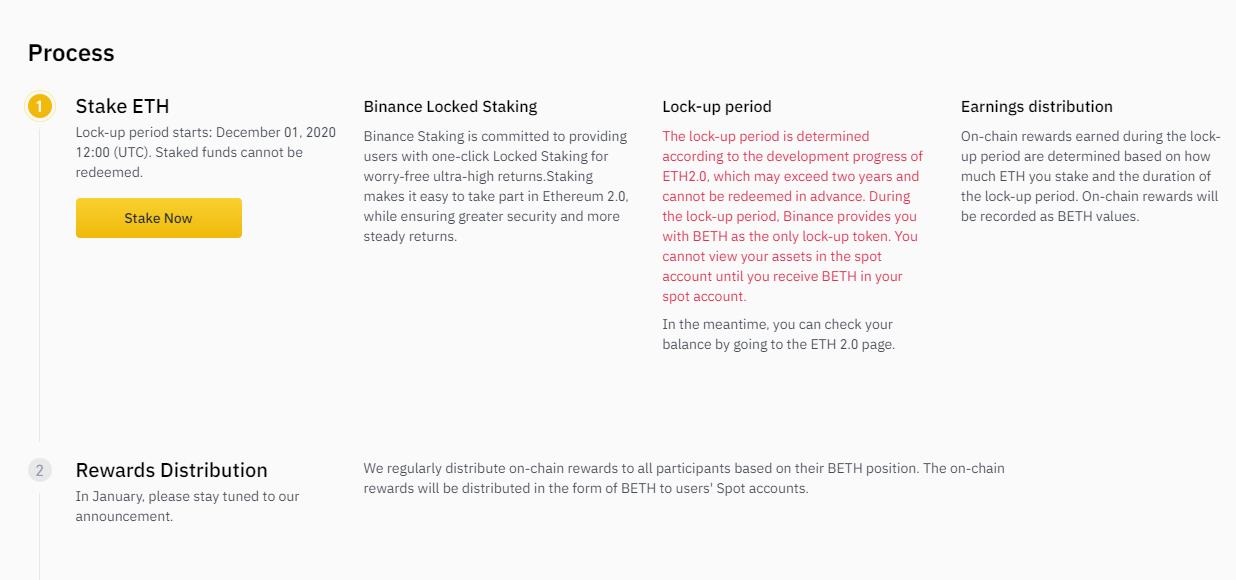

ETH 2.0 Staking

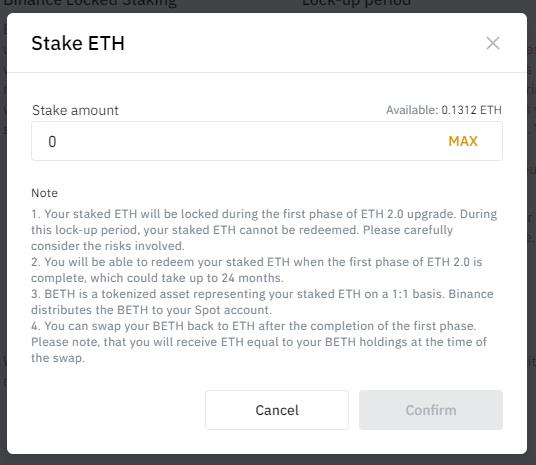

ETH 2.0 Staking is a pretty complex process. Binance has created its own product. It is a simple to click staking product. The staking period started on December 1, 2020. Note that your funds will be locked, and the lock-up period will be as determined by the progress of ETH 2.0 (can continue up to two years). For now, Binance will provide BETH tokens. BETH is a 1:1 peg with ETH. Binance will record the on-chain rewards in BETH. This will be distributed in the user’s spot account. ETH can be redeemed after Ethereum implements shard chains (at a ratio of 1:1).

Click on Stake Now

Select the amount and confirm.

Note: In this case also, the users will not hold the private keys.

High-Risk Products

Below are the high-risk products offered by Binance.

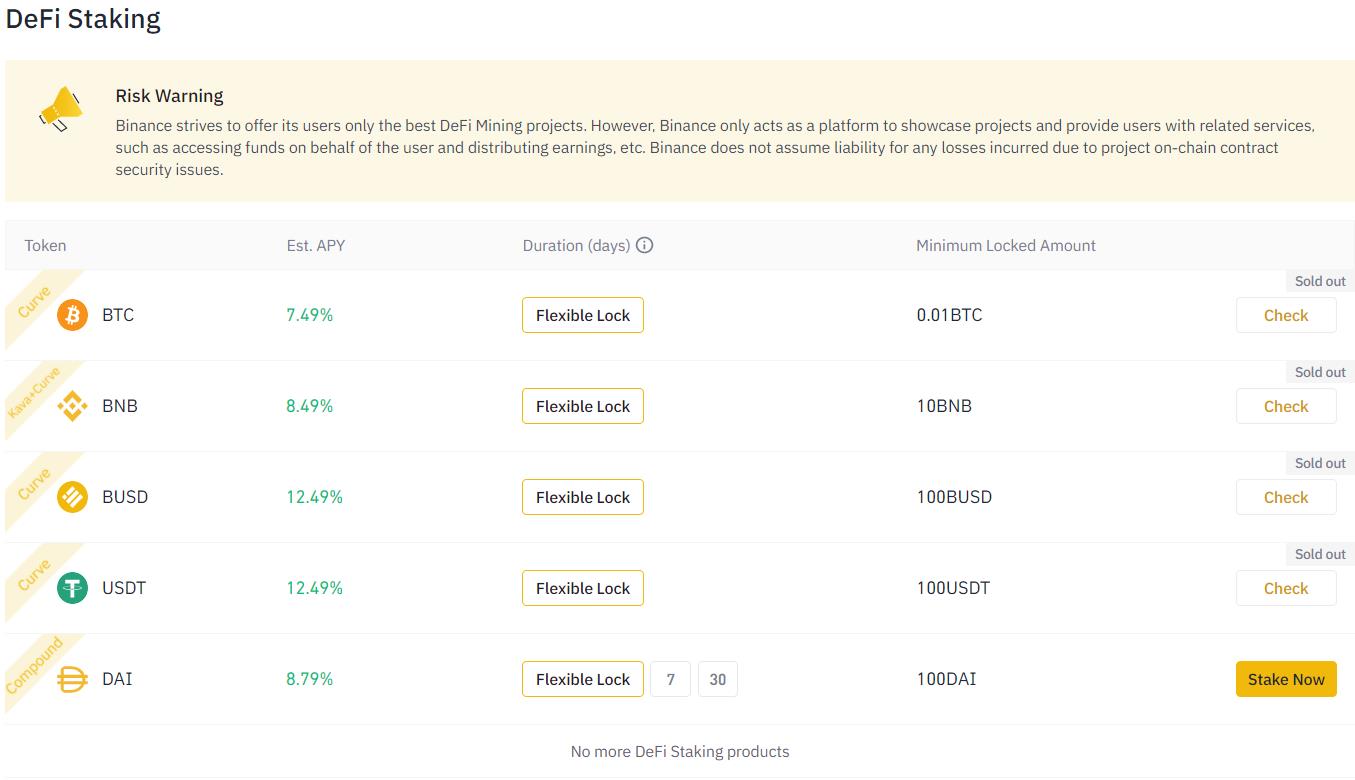

Defi Staking

Binance Defi Staking allows the users to participate in certain Defi products and earn a high-interest rate. Defi staking is quite simple and easy to use. One doesn’t require to have complete knowledge of the complex Defi staking process. You can simply use the Defi staking facility offered by Binance and enjoy generous online rewards without having to keep an on-chain wallet.

However, one thing to note here is that the users will not have their private keys, and Binance does not take any responsibility for user funds in case of smart contract failure.

Binance uses existing decentralized platforms like Compound. They act as an interface only. All risks are owned by users.

There is a minimum amount needed to start Defi staking. Check all parameters and understand your risks very clearly.

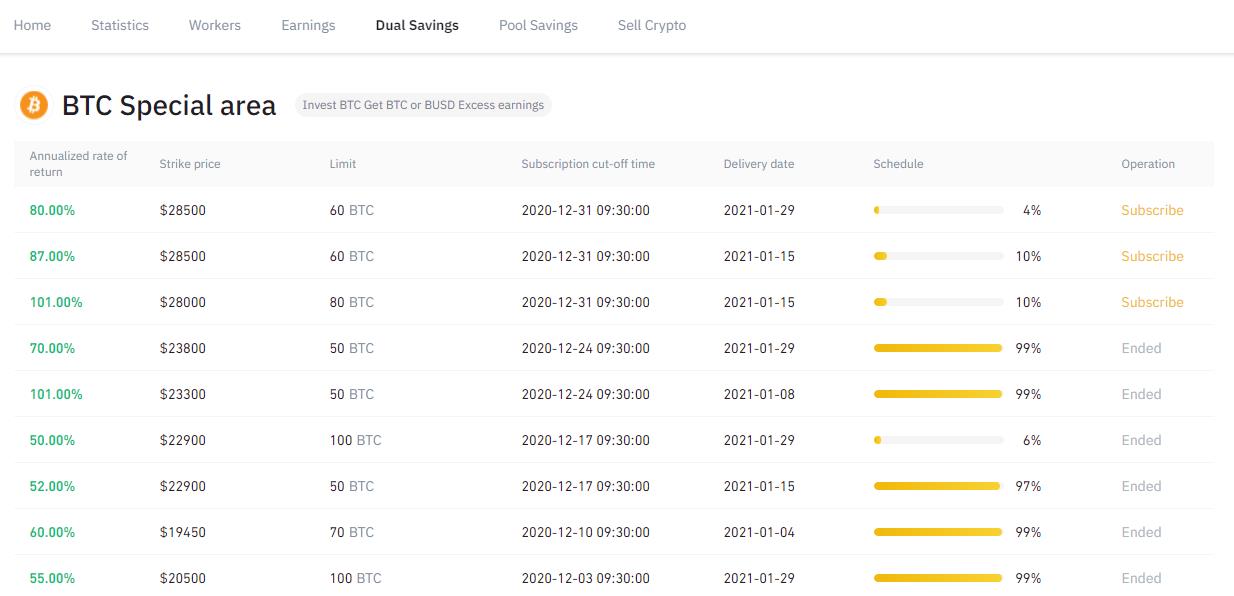

Dual Savings

With Dual Savings, the user purchases a currency, and the final settlement takes place in either BTC or BUSD. Upon expiration, the final settlement currency is determined by comparing the price of the coin and the pegged price at the time of settlement. Dual Currency Investments is a non-principal-protected financial management product that offers floating returns. Although the rate of return is fixed, the final settlement is determined based on the settlement price and the pegged price. Therefore, the risk associated with Dual Currency Investments mainly lies in the high rate of market volatility. Users are advised to invest with caution once they fully understand the risks.

Note: The returns might look very high, but do your own research before investing in such a high-risk product

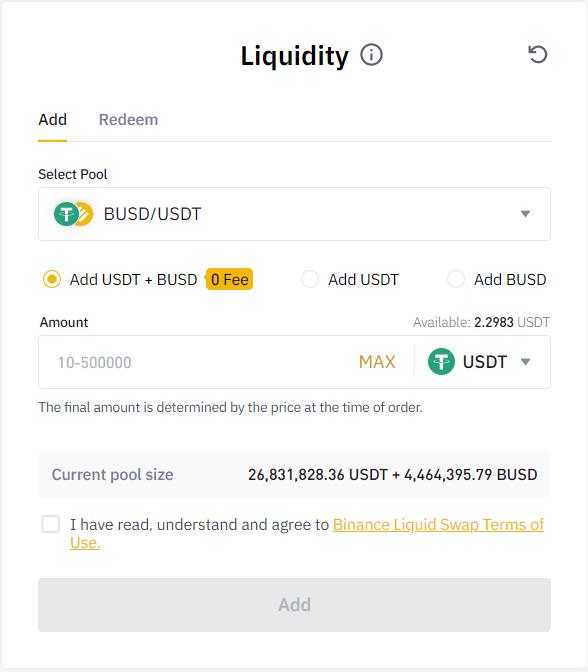

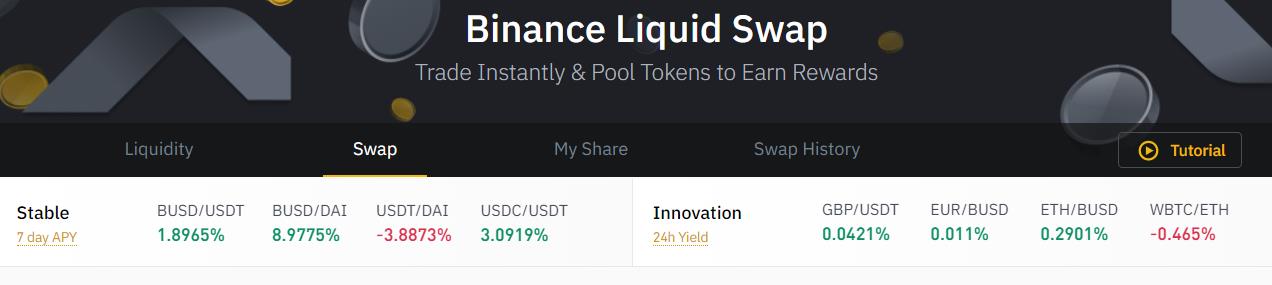

Liquid Swap

Liquid Swap consists of an AMM (Automatic Market Maker) principle-based liquidity pool that consists of two digital tokens or fiat assets.

You can provide liquidity in the liquidity pools and earn transaction fees from users in the pool and flexible interest.

You can redeem your share at any time. Note that you will be susceptible to impermanent loss, as usual. You can also redeem one asset (instead of two like in Uniswap). In this case, the platform will swap half the value of that one coin into another coin, then add the two coins.

Liquid Swap is of two types:

- Stable Investment

- Innovative Investment

Stable Investment: The price of the pair in the pool is affected slightly by the exchange rate or token price fluctuations. The rate of return for a Stable Investment is more than even that of an Innovative Investment.

Innovative Investment: The price of the pair in the pool is greatly affected by the exchange rate or token price fluctuations, and the rate of return fluctuates greatly.

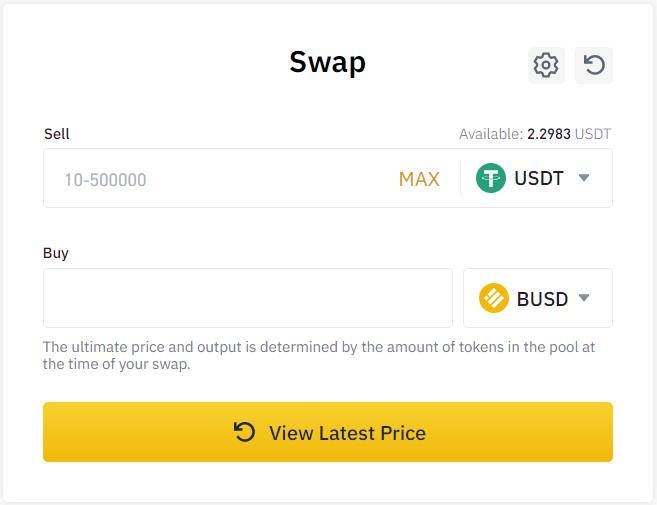

Swap

Using the Swap feature of Liquid swap, you can convert one coin into another.

Select the token you want to sell. The application will show you the token range that users can opt for when selling.

Enter the amount of token you wish to sell and select the desired token that you want to buy.

The application will then display the output token you will receive along with the fee and slippage charges.

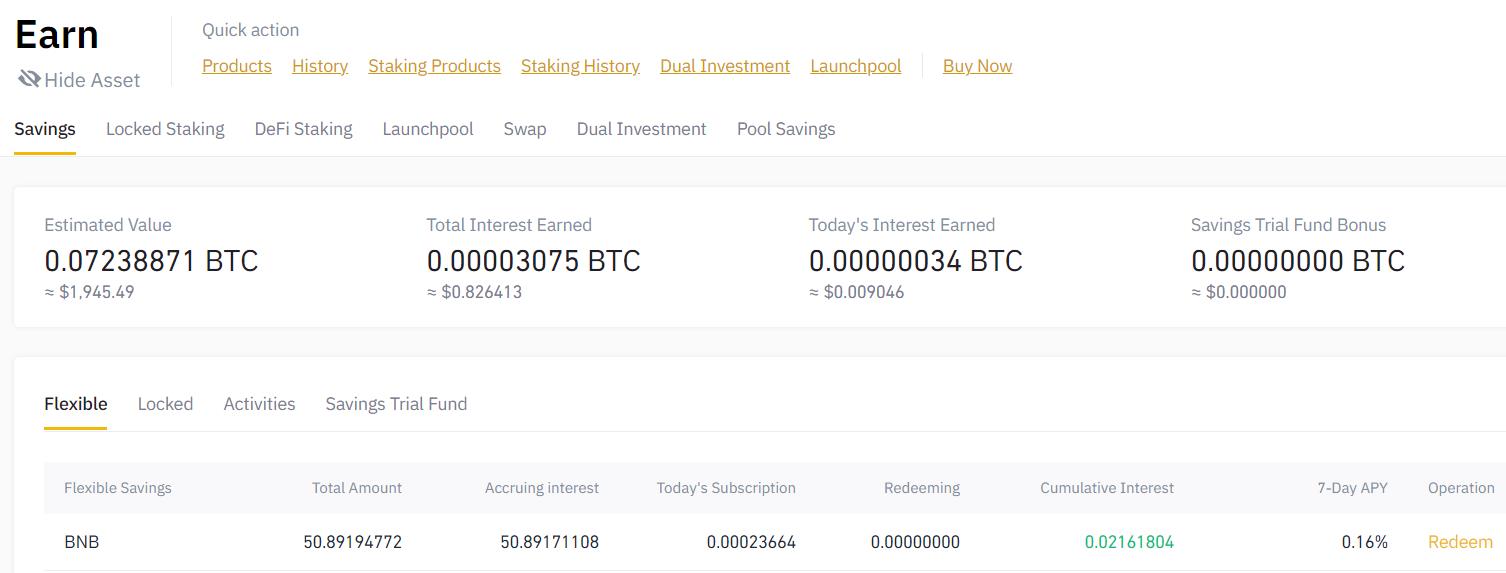

Check Your Collective Investments in Earn

Check your staked asset details from the Earn tab (under wallet) for various products.

The below screenshot shows the token locked in flexible staking.

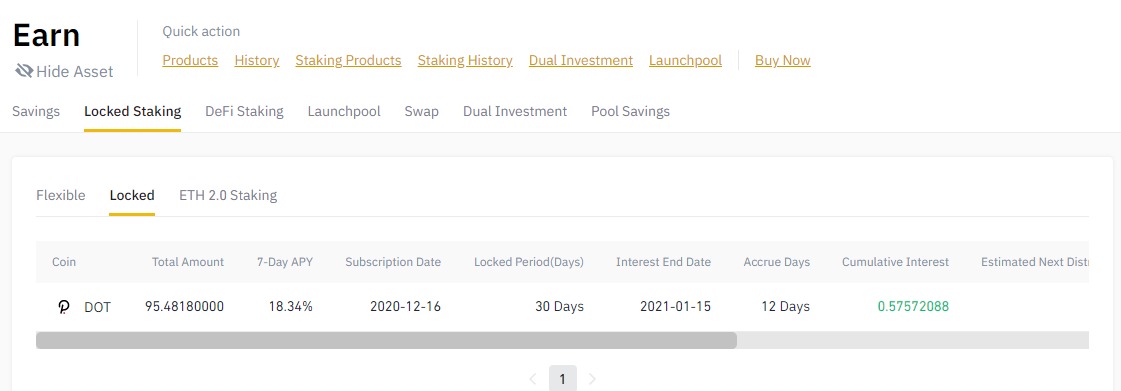

We have some DOT staked in locked staking, which you can check from the Locked tab.

Conclusion:

Binance has so many features that it is sometimes easy to get lost. The platform grew very fast and is now slowly consolidating its product. Altcoin Buzz hopes this series helped you.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

So which one would be the best investment option that gives high return and low risk?