As the SEC announces more enforcement actions, Bitcoin struggles to maintain above $21,500. With most of the market in the red, only a few tokens saw slight gains. Many projects had double-digit drops, and the entire market worth of all cryptocurrencies dropped back below $1 trillion. What is happening in the market?

As bulls fail to cover lost ground from February, Bitcoin opens the new week barely under $22,000. BTC/USD is staying close to three-week lows as a new status quo emerges, with $22,000 acting as a barrier after some small volatility at the weekly finish.

However, the most prominent cryptocurrency is still in place at the start of a crucial week for macroeconomic data, so there are still chances for volatility to resurface.

The first volatility could come from the January print of the Consumer Price Index (CPI) for the United States, which will be made public on February 14. The release of further data will continue throughout the week, and experts will closely watch how the cryptocurrency markets and the U.S. dollar react.

At the same time, a formidable new chart event is unsettling some. Can Bitcoin escape substantial fall as its first-ever weekly “death cross” confirms?

CPI and the Death Cross

The announcement of the CPI for January on February 14 will most likely dominate the macro environment this week.

Bets are on inflation declining further, which might support risky assets despite a drop in early February.

A change in the CPI calculation has muddled the picture, although economists question its importance given the general downward trend in inflation.

But this month’s print is being eagerly watched outside the crypto community. The degree to which CPI influences Federal Reserve policy changes is also under discussion after Chair Jerome Powell said late last year that another statistic might be the “most significant” instrument for tracking inflation.

Let’s move to the Bitcoin charts.

Bitcoin is trapped between two “crosses” this month, a peculiar situation with conflicting perspectives on its relevance.

A “death cross” on the weekly chart converges with a “golden cross” on daily time frames.

The latter is unique to BTC/USD, although substantial price declines have often followed a death cross in other periods.

It remains to be seen whether the daily golden cross will follow past trends and support the market, but in the meanwhile, a brand-new cross is emerging.

Additionally, for the first time, the one-year exponential moving average of Bitcoin is likely to cross below its three-year counterpart. The fact that this crossing has never occurred before emphasizes how harsh the BTC bear market is.

In reality, the event occurred in the middle of December 2022, but since then, the one-year EMA has been falling further below the three-year and two-year EMAs.

Another potential first-of-its-kind occurrence would be for the two-year EMA to pass below the three-year EMA.

BUSD Debacle: Is the U.S. Declaring War on Crypto?

Stablecoins are the arcade token of the cryptocurrency world. The stablecoin issuer takes one unit of money in return for a blockchain record with the same value. Therefore, $1 equals $1 $BUSD or $1 $USDT. Then, entities can buy other cryptocurrencies directly on the blockchain or carry out more trades, loans, transfers, and transactions using these dollar equivalents.

The stablecoin issuer gets to keep the actual dollars and get any interest generated on these assets in return for establishing a dollar equivalent on the blockchain.

To guarantee that their reserves always match the value of the stablecoins they have issued, the issuer undertakes explicitly to store all of these assets in secure and liquid assets. In other words, a stablecoin issuer should operate similarly to a basic money market fund.

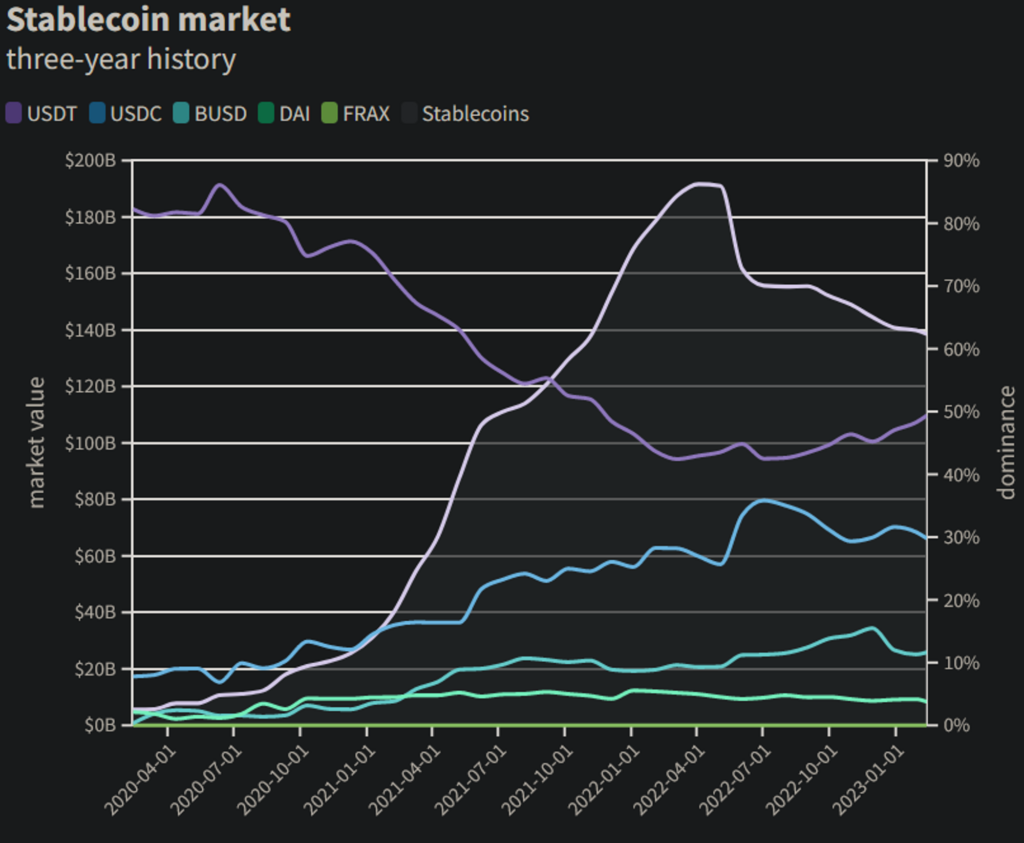

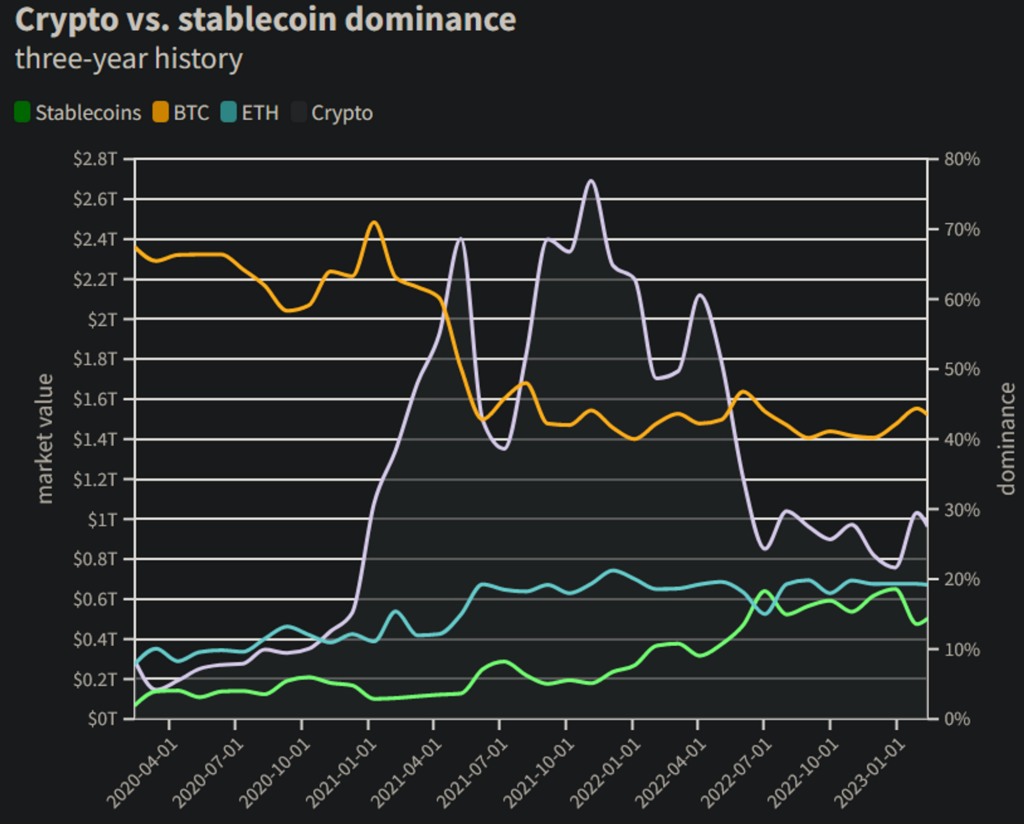

In the cryptocurrency market, there are three sizable stablecoins with a combined market valuation of almost 14% of all cryptocurrencies. Together, these three stablecoins account for more than 99% of the market’s liquidity.

Current Status

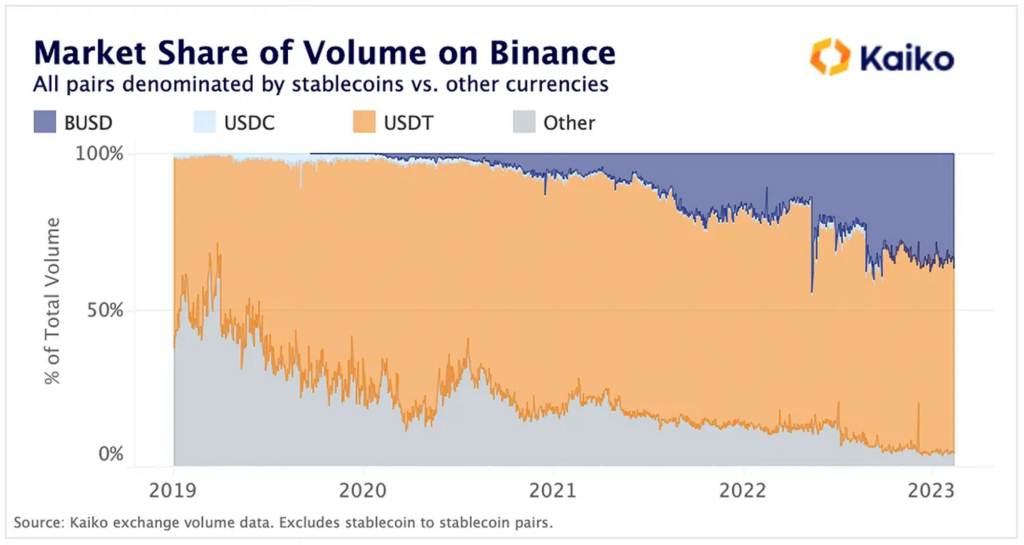

The third-largest stablecoin, BUSD, has a market worth of over $16 billion and represents 35% of all trading activity on Binance.

Even though Binance USD bears the name of the biggest exchange in the world, the Paxos Trust Company issues the stablecoin. They hold the BUSD’s underlying reserves.

Recently, the U.S. SEC has informed Paxos Trust Co. that it intends to file a lawsuit against the company for allegedly breaking investor protection rules and for issuing and listing Binance USD, a digital currency that the SEC claims are unregistered securities.

Following the news of the SEC’s legal action, Binance said it would examine projects in unsure markets where regulatory uncertainty might harm its customers.

Shortly after, the New York Department of Financial Services (NYDFS) ordered Paxos Trust to cease issuing Binance USD. The NYDFS said it had demanded Paxos owing to several unresolved issues, including Paxos’ oversight of its business partnership with Binance.

Paxos has now said that it is severing ties with Binance for BUSD.

Even though the U.S. SEC and New York authorities have ordered issuer Paxos to cease minting the stablecoin, Binance CEO Changpeng “CZ” Zhao said the exchange would continue to offer BUSD.

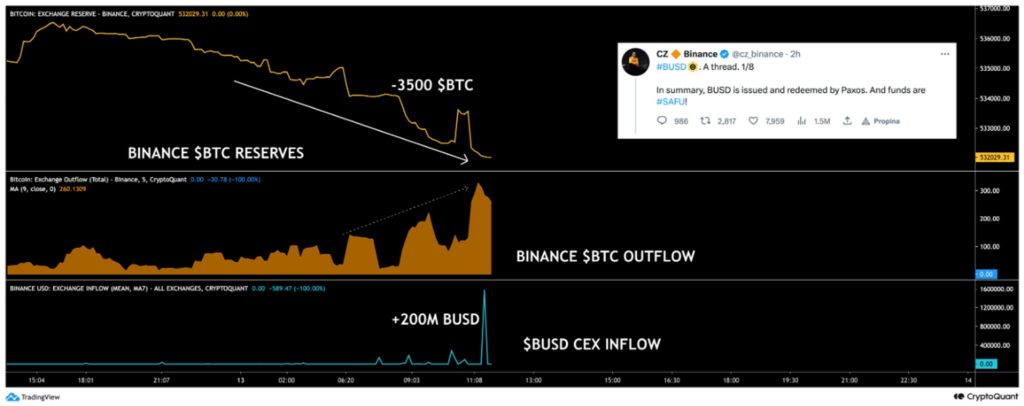

Following CZ’s most recent tweet, investors have begun to act. Within a few hours, we have seen significant deposits of $BUSD in all CEXes and Bitcoin outflows from Binance totaling roughly 3.5k $BTC.

What Is the Latest?

According to blockchain statistics provided by Nansen, users have withdrawn more digital assets in the previous 24 hours than they have deposited ($2.8 billion against $2 billion).

The regulatory hammer is coming down, which is the theme that connects to a more significant pattern we’ll see this year. Too many things happened too rapidly in 2022.

The collapse of Terra/Celsius/3AC/FTX caused many casualties and provided the Feds with the ammunition they needed to target businesses and enact regulations, something they had probably long desired.

In the most recent major instance, the SEC levied two accusations against Kraken for its staking products. The exchange paid $30 million and stopped providing staking services in response to both SEC complaints.

In the BUSD case, there is still a lot of uncertainty. Since a stablecoin has no innate expectation of reward, it is unclear how it would qualify as a security.

It is still unclear how long the uncertainty will persist and if this will lead the cryptocurrency markets to fall even further during the year as more inevitable enforcement measures are enacted.

Tether: Dominant as Ever

Tether (USDT) is once again consolidating as cryptocurrency’s preferred pegged token, with its stablecoin market share approaching 50% for the first time since December 2021.

The largest stablecoin issuer currently has a $68.4 billion circulating supply, growing around 3%, after deploying an extra $2.4 billion USDT this year.

The supply of Circle’s currency, USDC, has decreased by more than $3.3 billion this year. There is now $41.2 billion USDC available in the cryptocurrency ecosystem, a 7.5% drop.

This year, the total stablecoin market has declined by 1.5%, losing slightly more than $2.1 billion.

As FTX crashed in November, total stablecoin dominance hit a record high just below 20%, but it has since retreated to 14.38% as the cryptocurrency markets have recovered.

With a Rise in Price, Bitcoin Miners Get Some Much-Needed Relief

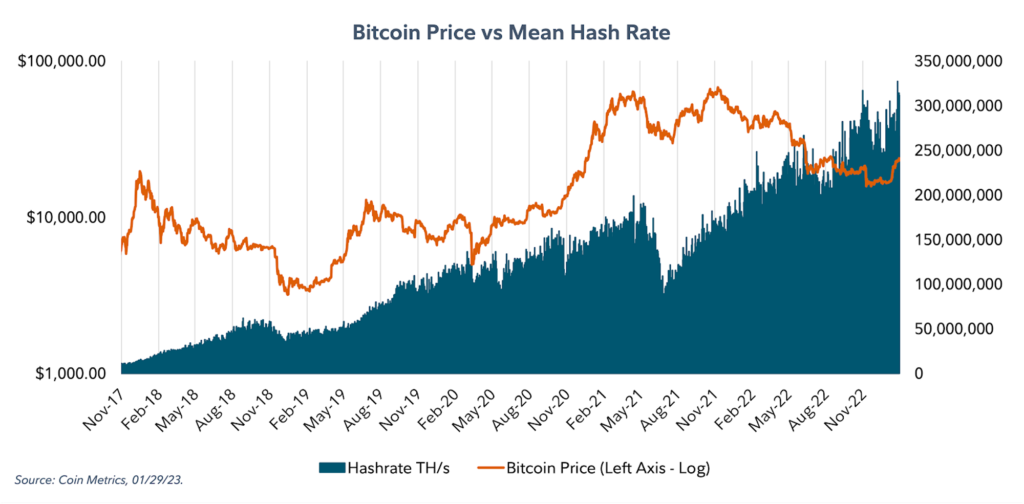

According to Coin Metrics, Bitcoin’s hash rate has increased by another record-breaking 311 EH/s, or slightly over 13%, in January alone. This increase is hardly surprising considering that Bitcoin mining resumed being lucrative about the same time the price increased by almost 40%.

Even if the price of Bitcoin dropped during the majority of 2022, miners endured constant increases in hash rate and difficulty changes. So this rebound must have been a much-needed relief.

Given that miner profitability and Bitcoin’s capacity to support miners incentivizes the entire security budget, it is also a relief to network members.

The broader picture is that miners have repeatedly shown us that they are in it for the long haul and that short-term price fluctuations won’t deter them from carrying out their mining.

A Unique Pattern on the BTC Chart?

After adding the 200-day moving average line (in blue) and realized price (in orange), the long-term Bitcoin chart reveals a pattern previously seen at market bottoms.

The 200-day moving average from the top to the realized price crossing or overlapping often signals the emergence of a long-term bottom.

The most recent occurrences of this pattern were in 2019, 2015, and 2012, after which Bitcoin had a long-term upward trend.

In this case, it is essential to consider the macroeconomic variables that have placed pressure on the markets for high-risk assets.

It will be interesting to see whether Bitcoin can separate from investments like stocks and act as a store of value during inflationary periods.

Is the Correlation Between Bitcoin and Gold Surging?

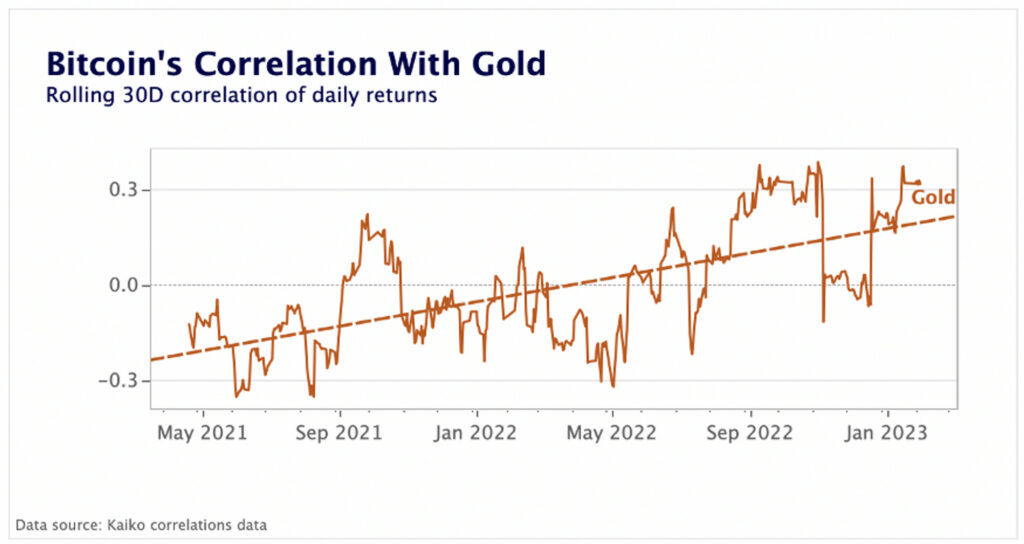

While Bitcoin’s correlation with risk assets has declined in 2023, stabilizing at around .5, it has surged to its continuously highest levels in more than a year with gold, a safe-haven asset.

The prices of gold and Bitcoin both rose sharply in January before falling a little in February as rate expectations climbed in the wake of a favorable U.S. employment report in January.

A high-beta version of gold, Bitcoin has generally outperformed gold this year, with the BTC to gold ratio reaching its most significant level since the FTX meltdown. Still just marginally favorable, the correlation between the two assets is slightly above 0.3.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.