Bitcoin has been in the news over the last few weeks, thanks to its recent resurgence.

Rania Gule, a market analyst at XS.com, recently shared her analysis of Bitcoin ahead of the Bitcoin halving.

Bitcoin Price Debate Intensifies Before Halving Milestone

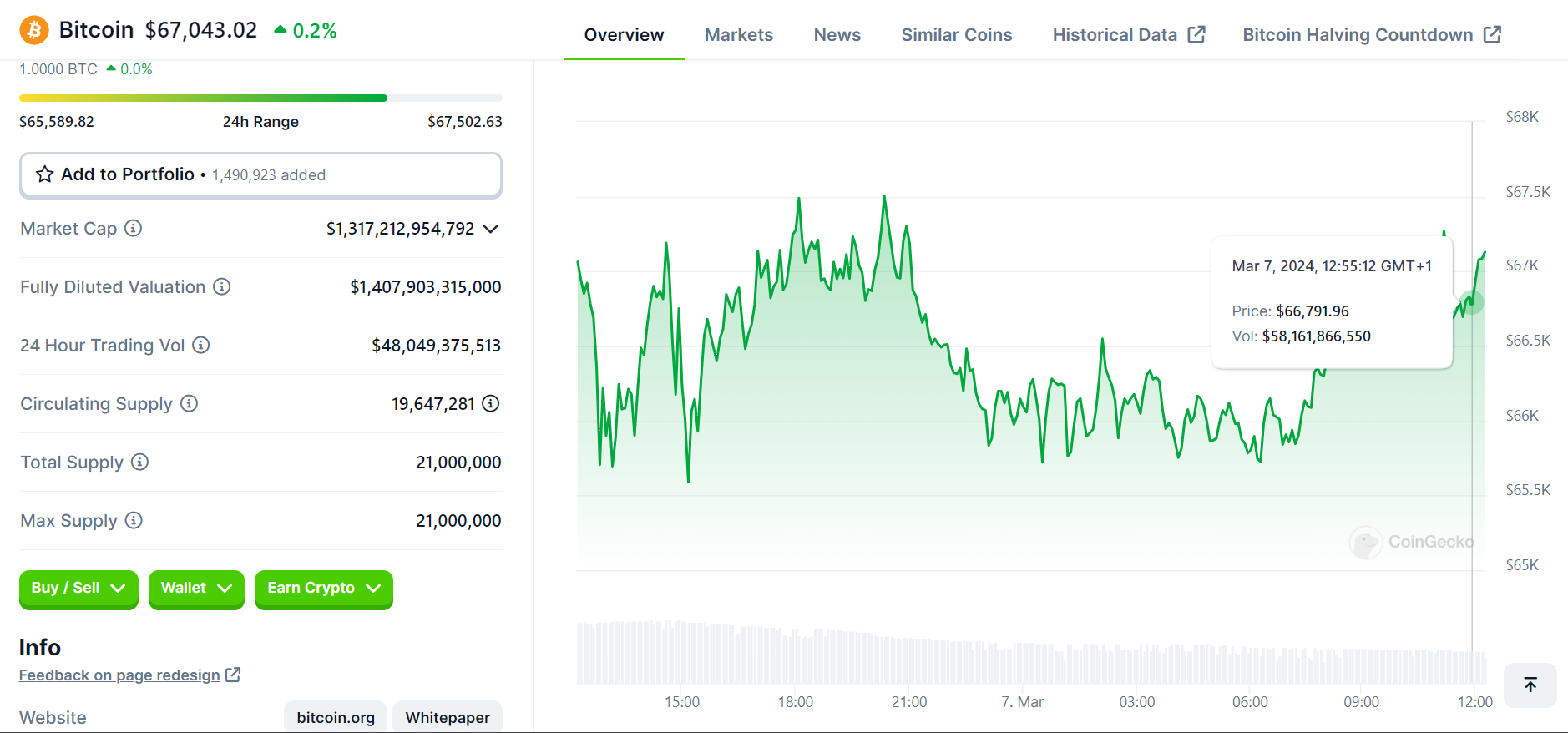

Bitcoin recently hit a new all-time high before falling from that height. However, BTC has stabilized above the $65k mark. But, Gule, in her piece shared on Tuesday, March 5th, believes the cryptocurrency could crash even lower ahead of the halving.

Gule explained: “Historically, the price of Bitcoin decreased in the days leading up to the halving event. I anticipate a decline in the Bitcoin price to $45,000, possibly $42,000, or even $37,000, especially with the Federal Reserve maintaining high interest rates.”

#Bitcoin: A Guiding Light in the World of Finance 💡 Gaining understanding, overcoming barriers, and entering the future! pic.twitter.com/GSQ5apyclu

— Bitcoin (@Bitcoin) March 7, 2024

Gule claims that economic situations could affect BTC’s performance. She believes that long-term high-interest rates are detrimental to the economy. Central banks deliberately maintain high-interest rates to restrict economic activities. While they achieve their goal of reducing inflation, this could potentially lead to a recession.

Countries like Japan and the UK are already in a recession. However, markets could see normalcy if other countries confirm recessions. So, Gule writes that a “correction in Bitcoin’s currency, possibly reaching $45,000 or $42,000, is likely fair.”

Source: Coingecko

“I think this downturn is logical before the scheduled BTC halving event in April 2024, potentially resulting in a correction in BTC prices. Three previous Bitcoin halving events witnessed a significant price drop about 30 days before the event, followed by an increase in the original price in the months and weeks after the mining reward halving,” Gule adds.

Conclusion

Gule concludes that a short-term drop is possible if history repeats itself. However, things might be different this time. The presence of Bitcoin ETFs could potentially change the halving narrative. Unlike previous halving events, institutional investors are going heavy on demand. And this can maintain the upward momentum.

#Bitcoin investors are propelling the cryptocurrency to new heights! 🚀 pic.twitter.com/qlsLXc9N3W

— Bitcoin (@Bitcoin) March 6, 2024

The continued upward movement is predominantly powered by institutional players, with retail traders staying cautious. This hasn’t happened in other halving cycles and might have a favorable effect on the pre-event pricing this time.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.