In the previous part of this article series, we explained how you can stake your XCAD tokens in the AscendEX exchange and NFTrade platform and earn rewards. In this part, we will describe how you can provide liquidity into different supporting pools from various platforms and later stake your LP tokens into the XCAD LP farm to multiply your rewards more.

XCAD tokens holders can enjoy high rewards through yield farming. XCAD Network users can provide liquidity on various platforms like Uniswap, Orion Protocol, etc., and then stake those LP tokens into the pool to receive more rewards.

Yield Farming

Below are the platforms that are offering yield farming facilities for the XCAD token:

-

Table of Contents

XCAD LP Farm (Uniswap)

Uniswap is a major decentralized exchange (DEX) on Ethereum that allows the users to swap any ERC-20 token.

XCAD users (ERC-20 standard) can add liquidity into the XCAD/USDT liquidity pool on UniSwap. They can use these LP tokens in yield farming in the XCAD LP Farm and earn an APY of 430%. The rewards will be paid in XCAD tokens.

We will now explain how you can add liquidity into the Uniswap pool, and how you can stake the LP tokens in the XCAD LP Farm.

-

Add Liquidity on Uniswap

XCAD LP Farm requires LP tokens from Uniswap with token pair XCAD/USDT. We have some XCAD and USDT tokens in our wallet that we will use to add liquidity into the Uniswap pool.

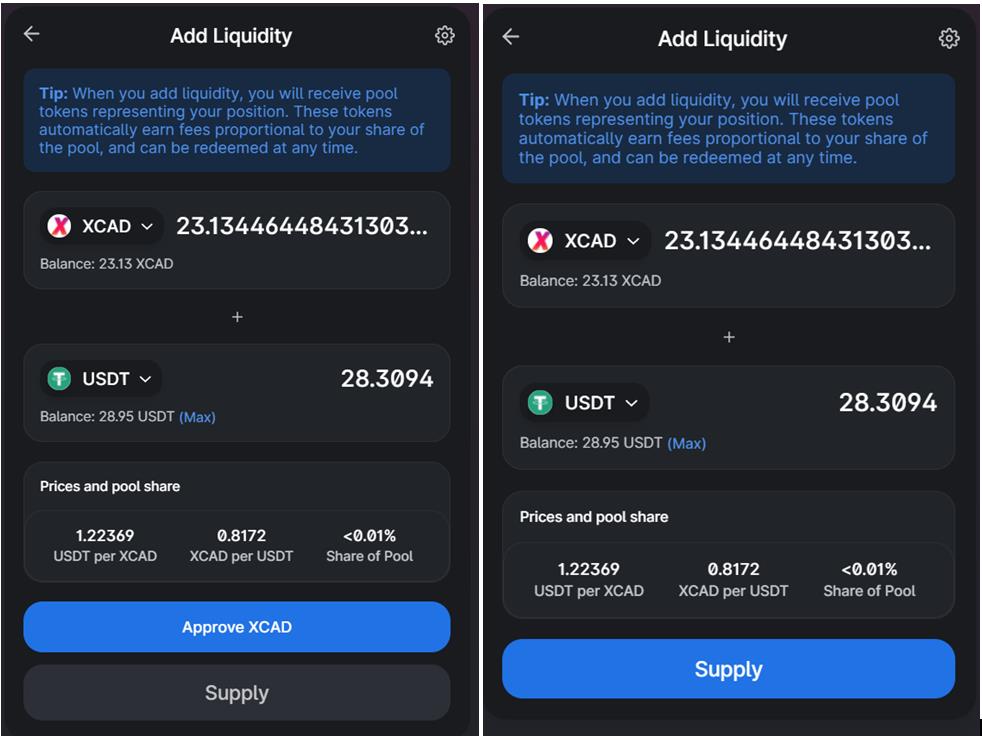

To add liquidity, go to the Pool tab and click on Add. Select XCAD and USDT as your token pair. While providing liquidity to the pool, users have to pay an equal amount of each of the two tokens that are being added to the pool.

When the user enters the value of one token, the appropriate value of the other token will be automatically configured.

NOTE: You will have to approve the token pair before adding it to the platform’s liquidity pool if you are using them for the first time.

Once you have added to the liquidity pool, you will be shown how much your share in the pool is as a percentage. Make sure to confirm the Supply.

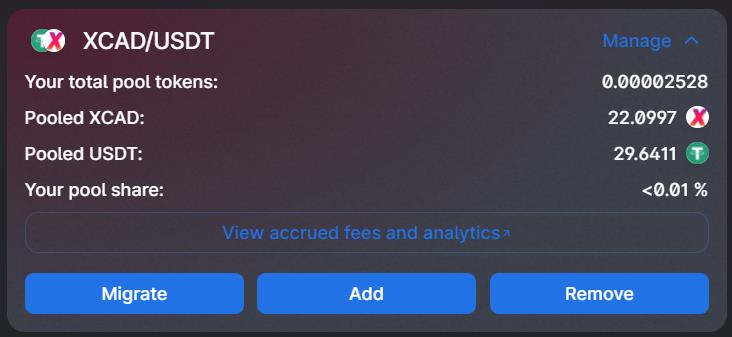

The end result of the successful transaction is that you will be a liquidity provider for the pool you added the tokens to. For every transaction using that liquidity pool, you will now gain a liquidity fee.

You can check the details of your liquidity now.

-

Stake XCAD/USDT LP Tokens On the XCAD LP Farm

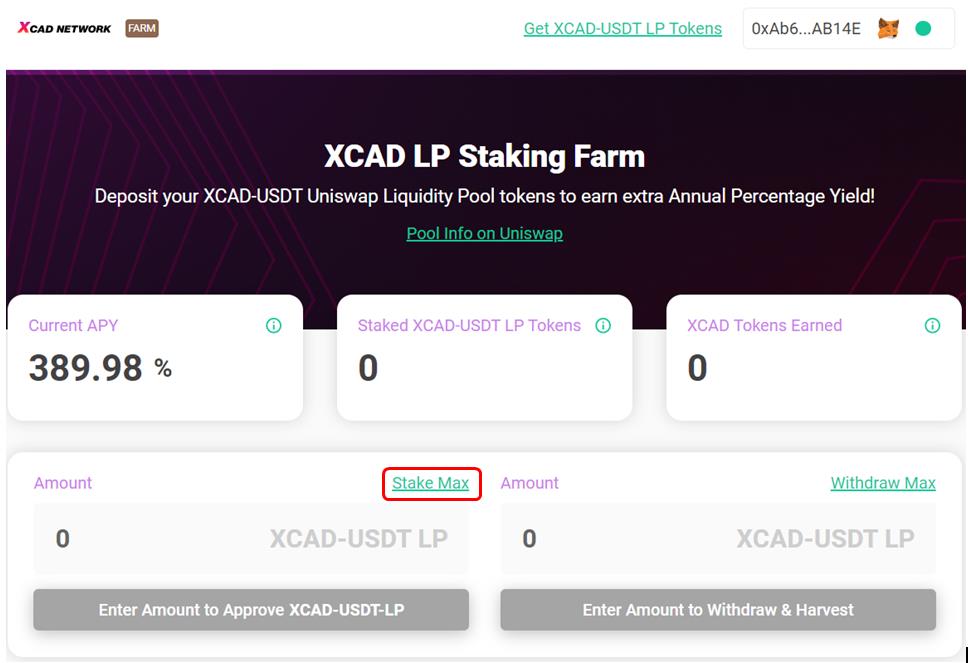

To stake your LP token, visit this link, and connect your MetaMask wallet.

Click on Stake Max. A page will pop up where you can enter the amount of LP token that you wish you stake.

Now finally click on Approve XCAD-USDT-LP button. A MetaMask transaction will then be triggered. You will need to confirm the transaction.

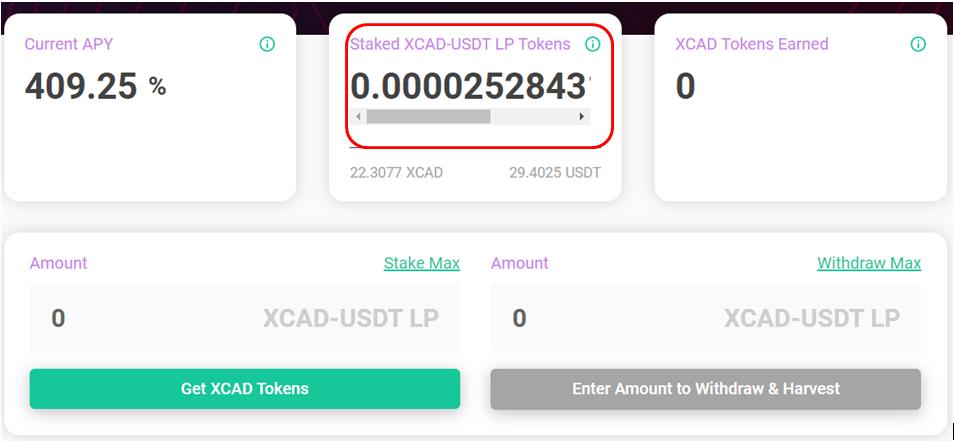

Once the transaction is successful, you can see your staked tokens details.

As you can see from the above screenshot, the platform is offering a current APY of 409.25%, which is quite high.

You can check the earned reward details from the XCAD Tokens Earned section.

-

Withdraw XCAD LP Token

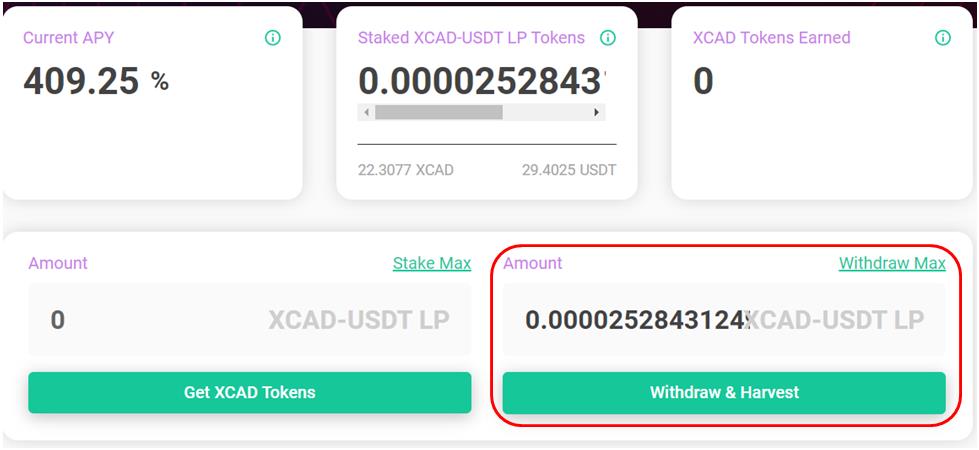

To withdraw your XCAD LP tokens from the pool, you can enter the amount that you wish to withdraw in the Withdraw section and click on the Withdraw & Harvest button.

This will withdraw your LP tokens, along with all the rewards accumulated during the staked period in your MetaMask wallet.

You can further go to Uniswap and remove your XCAD-USDT liquidity to get your tokens back.

Users from other blockchains can follow the same procedure to add liquidity into the liquidity pool and for yield farming.

We have listed the different protocol/platform names where users can stake their LP tokens and earn rewards.

Orion Protocol is a decentralized platform that aggregates liquidity, order book depth, and price discovery from major centralized and decentralized exchanges.

XCAD token holders can provide liquidity into Orion Protocol’s liquidity pool using the token pair XCAD and USDT. Note that the supported token pair should be BEP-20.

Users can then further stake their LP tokens and earn a reward in XCAD token with a current APY of 290%.

ZilSwap is a decentralized exchange that runs on Zilliqa.

Zilliqa users can add liquidity into ZilSwap’s liquidity pool by using the token pair XCAD/ZIL. The rewards will be paid in ZWAP tokens with a current APR of 30%. It supports only the ZRC2 token standard.

QuickSwap is a decentralized exchange (DEX) based on Ethereum, powered by Polygon Network. It is a fork of Uniswap and has been based on Layer 2. Thus, it charges a low transaction fee.

XCAD users can provide liquidity on the QuickSwap liquidity pool with the XCAD/USDC token pair (Polygon standard). The rewards will be paid in QUICK tokens with a current APY rate of 1250%.

For more info on XCAD staking and LP farming, visit the link here.

Conclusion

Staking and yield farming is one of the innovative and common methods to support the project and its network operation, along with earning an attractive reward on a yearly basis. XCAD Network provides the facility of staking and yield farming to users belonging to four major blockchains (Ethereum, Polygon, Binance Chain, and Zilliqa). So, if you are not willing to pay the high gas cost in the Ethereum network, you can try staking your XCAD/ XCAD LP tokens on the other three networks. The platform allows the users to earn high APY via yield farming. However, we have noticed that the platform is quite slow and transaction processing is taking too much time. If you experience any issues, you can reach out on their Discord server.

Resources: XCAD Medium Blog

Read More: Binance Chain Wallet: How to Setup and Use the Wallet Direct Feature