With the current economic climate of many countries around the world, MahaDao wanted to create an asset that would protect the buying power of holders – ARTH, the world’s first “value-stable coin.”

Introduction

MahaDao – a decentralized autonomous organization (DAO) built on Matic – hones in on implementing the concept of a two-token infrastructure (similar to MakerDao’s $MKR and $DAI). MahaDao’s MAHA is a governance and utility token that gives the power to its token holders to vote on savings rates, stability fees, direction, and future course of action for the ARTH coin.

ARTH (a value-stable coin) is designed to fight the depreciation of wealth. This value-stable coin is backed by uncorrelated assets, pegged to a GMU (Global Measurement Unit), and consisting of 80% global fiat currencies, 15% Gold, and 5% Bitcoin. ARTH provides wealth creation with minimal volatility due to the diversity of its backed assets (fiat, gold, BTC) – different from stablecoins like USDT, DAI, BUSD, which are usually pegged solely to fiat currencies.

Team

The founders of the project are Steven Enamakel (creator) and Pranay Sanghavi (co-creator). The MahaDao team consists of nine individuals that work on the day-to-day operations as well as six advisors who bring a wide array of skills and experience (strategy, marketing, design, and legal) to the project.

Technology

The technology and process behind creating ARTH tokens bring a new outlook to the crypto space. ARTH uses a vault as a way to manage the underlying collaterals that have been locked to generate a token (similar to MakerDao). But, it builds further on this concept to create a sort of decentralized reserve bank – borrowing concepts like DSR (Dai savings rate), emergency shutdown, stability fees, etc.

The vault produces ARTH tokens by locking in collaterals and then creating new ARTH tokens against them (in the form of debt). Once the debt is paid back, the collateral is released and the ARTH tokens are burned. In the instance where the vault needs to rebalance the underlying collaterals, the ARTH vault will act as a reserve bank and systematically buy/sell the underlying collaterals for one another – ensuring all collateral buying power ratios are met.

Competitive Advantage

The main selling point for MahaDao that sets it apart from other projects in this space is this idea of a “value-stable coin.” Because MahaDao is the first project to come up with this idea of a coin that can preserve as well as create wealth, there are no clear competitors to this project at the moment.

The closest competitor is MakerDao. Maker is a governance and utility token (similar to MahaDao) for its stablecoin, DAI. But, MahaDao’s ARTH is different from DAI in that it is not solely pegged to a fiat currency but rather a diverse basket of assets with the majority of the weight in fiat currency to eliminate most of the volatility in the market while still reaping the benefits from holding assets like gold and Bitcoin – which have historically appreciated over time.

Use Cases

MahaDao has three main use cases:

- No transaction fees: The team built MahaDao on the Matic Network, which means all transactions for users to send/receive ARTH are free. This is possible because the system can integrate third-party applications at little to no cost.

- Fast transactions: The team have worked to develop the ARTH coin to be as fast as three seconds per transaction.

- Friendly User Experience (UX): Many DeFi projects struggle taking into account less-experienced DeFi users. MahaDao does a good job at resolving this through a smooth/straightforward platform.

Tokenomics

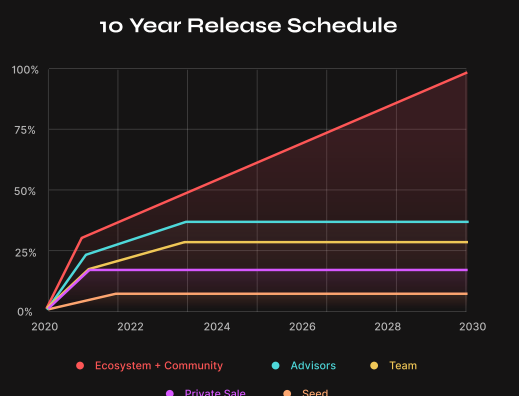

There will be a total supply of 10 million MAHA tokens accessible over 10 years. The initial allocation is as follows:

- 70% to MAHA community members

- 15% to private sale investors

- 7% to team members and future employees

- 5% to seed investors

- 3% to advisors

Image Source: MahaDaoTokenomics

Social Networks

Conclusion

In conclusion, the buying power of fiat currencies continues to deteriorate due to the high inflation/depreciation levels in fiat currencies. MahaDao aims to solve this issue with their value-stable coin (ARTH). ARTH protects the buying power of its holders through its backing of a diversified basket of assets (fiat, gold, Bitcoin). This gives it a competitive advantage over its competitors, stablecoins. Stablecoins are pegged to fiat currencies, making them susceptible to deterioration.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.