DeFi has been gaining a lot of attention for quite some time. Different DeFi projects have been launched offering attractive returns to the users, resulting in a huge customer base and market value.

Most of the DeFi platforms are based on Ethereum. But what about the non-Ethereum users. How they will able to get the taste of high yield opportunity available in the market? Do they need to wait till they exit their position from non-ERC20 portfolio investment?

To overcome this situation and to leverage the non-Ethereum users the benefits of DeFi, RAMP DEFI came with a solution so that they can use the DeFi yields and benefits.

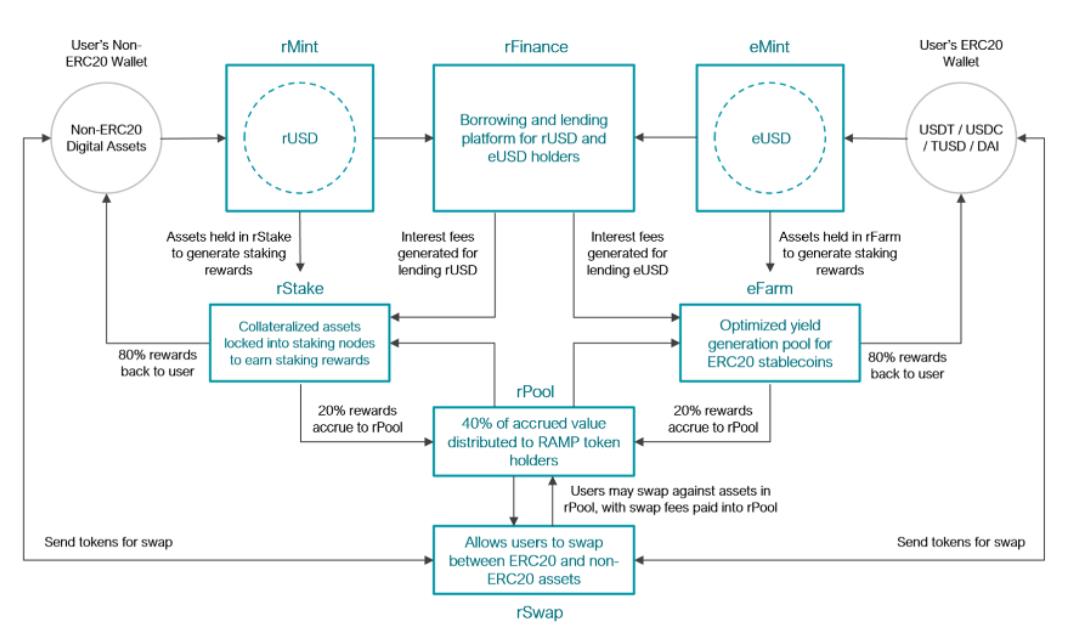

RAMP DEFI proposes that the staked capital on the various non-ERC20 staking blockchains can be collateralized into a stablecoin, “rUSD,” which is issued on the Ethereum blockchain via a gateway bridge.

By lending/borrowing, bootstrapping stablecoin liquidity, and integrating with other DeFi solutions, rUSD holders can either deploy their rUSD into yield opportunities to generate higher alpha on their assets or swap into USDT/USDC freely, creating a seamless capital “on/off-ramp” for users with capital locked into staking arrangements.

Table of Contents

Benefits of rUSD

Hold rUSD to get the below benefits:

(i) No need to inject additional capital for further trading or investment opportunities. Unlock staked capital and use it as liquidity.

(ii) Farm RAMP tokens by committing digital assets as rUSD collateral.

Different Products of the RAMP Ecosystem

As a part of the RAMP ecosystem, the platform is developing a suite of products that will help in powering the RAMP ecosystem and cross-chain value accretion.

The different building blocks of the platform is as follows:

rStake (Launched in 2020, With New Protocol Integrations in 2021)

rStake uses a non-ERC20 digital asset as collateral and mints a wrapped token against these deposits. It consists of staking nodes of all the participating non-ERC20 blockchains. Currently, rStake is integrated into the IOST, TOMO, and TEZOS blockchains, and these projects are in the alpha phase. It offers a reward to the users for depositing their assets in the combination of RAMP tokens and the underlying blockchain token. It generates fees for the RAMP ecosystem based on the staking rewards received, and approximately 70% of the staking rewards are returned to the user.

We will explore the rStake facility and see users can use this in our next article.

rMint (Launching in Q1 2021 Alongside rTreasury)

rMint takes non-ERC20 digital assets as collateral and mints rUSD against this collateral by maintaining a safe liquidation buffer.

The collateral assets can be sent and locked into rStake. rStake is one of the DeFi blocks of RAMP that consists of non-ERC20 blockchains staking nodes of all the supported blockchains. Users can stake their non-ERC20 tokens and earn staking rewards.

Vaults (Launched in 2020, With New Vaults and Existing Vault Upgrades in 2021)

Using RAMP Vaults, RAMP token users can participate in staking, liquidity pools for RAMP, and yield opportunity.

You can read our detailed guide on how you can stake your ETH-RAMP liquidity pool tokens into RAMP vaults and earn RAMP tokens.

rKeeper (Launching in Q1 2021 Alongside rMint)

The function of the rKeeper module is to manage the conversion of liquidated assets into stablecoins for rUSD value support and redemption. rKeeper captures the value of liquidated assets into USDT/USDC at the equivalent rUSD originally minted. The repurchase of rUSD by rKeeper will only take place when rUSD is less than 1:1 with USDT/USDC and focuses on creating stability and base support for rUSD value.

rBurn (Launched in 2020, With Product Upgrades in Q1 2021)

rBurn is designed as a “smart burn” mechanism that helps in removing RAMP tokens from circulation. It currently operates on the following parameters:

- Fees generated are exchanged into USDT and funded into buyback wallet address at a frequency of:

-

-

- once every 7 days, or

- when USDT accumulation reaches $5,000, whichever is earlier.

-

-

- rBurn executes a RAMP repurchase on Uniswap and sends RAMP into a burn wallet.

- In choosing execution timing, rBurn maintains an adjustable Support Level, and only executes the repurchase if:

-

-

- RAMP price is below the Support Level, or

- RAMP price stays above Support Level for 72 hours following buyback funding, whichever is earlier.

-

-

rFinance (Liquidity Exchange between Non-ERC20 and ERC20)

rFinance provides the lending and borrowing platform for rUSD and eUSD holders. rUSD holders can borrow eUSD and withdraw liquid capital. eUSD holders can borrow rUSD to compound their yield farming of RAMP tokens. The interest rate is determined by using a combination of demand-and-supply and market-relativity formulas.

rSwap (Cross-Chain Token Swaps)

Swap any ERC20 stablecoins into native tokens of supported blockchains (non-ERC20) by using rSwap. Users can swap their tokens against the assets in rPool, and the swap fee is paid into rPool.

rPool (Foundation of Value Accretion, Distribution and Insurance)

rPool is a central common pool that acts as a liquidity provider and also as a SAFE Fund for extreme cases of emergency. It allows collateralization insurance, liquidation execution, and cross-chain swaps for the RAMP ecosystem.

The more volume the protocol handles, the greater the fees collected. A percentage of these fees goes to the rPool. Services from which a percentage fee/reward goes into rPool include staking, yield farming, and fees generated (such as swap fees or liquidation fees). At regular intervals, RAMP token holders get a percentage of the value accrued into rPool.

rPool is used in case of a flash crash and if a user’s collateralized position decreases below its collateralization ratio.

RAMP Token

RAMP is the native platform token. The token holders take part in all the governance activities of the RAMP DEFI ecosystem. The community members can change/update proposals.

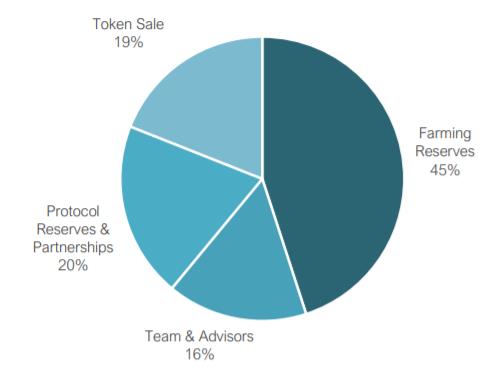

RAMP Total Supply = 1,000,000,000

The allocation of Total Supply is as follow:

The total token supply will reduce over time through buybacks and burn methods arising from rBurn.

Resources: RAMP DEFI Lite paper

Read More: How To Use the Guarda Wallet – Part II