The cryptocurrency industry has grown from being an obscure hobby among enthusiasts to disrupting the entire financial system. New investors have flocked to the crypto market, and we’ve seen increased mainstream adoption over the last few years.

However, given the large number of crypto projects available, it may be challenging for a novice to understand how to evaluate a project before investing.

How Should Crypto Projects Be Rated?

The best way to evaluate crypto projects is to conduct a fundamental analysis. In a fundamental analysis, you explore a project’s intrinsic factors to understand its fundamental value. There are several factors to consider during this analysis.

- The technology involved.

- Tokenomics.

- Roadmap.

- Team.

- Use cases.

This article will show you proven ways to evaluate crypto projects before deciding whether to invest.

Evaluate a lot of startups in the venture capital and startup space. Startups are a lot like web3 projects when it comes to evaluating them.

It's difficult to obtain symmetrical information about an early-stage project. A limited amount of information is being used to make a bet.— Sabrina🎈.ETH | BlockchainMagazine.eth | ۱۱۶۶.eth (@SabrinasNFT) June 18, 2022

1) You Need to Identify Market Needs and Its Use Cases

Evaluating a project must start with answering the above question. One of the easiest ways to identify a scam project is the hurry on the part of the developers. You’d realize that the project has unrealistic expectations, and sometimes you can barely figure out what problem they want to solve.

Crypto projects that offer real solutions to market problems tend to have long-term value.

2) Take a Good Look at the Tokenomics

Tokenomics is simply the policy that guides the minting, circulation, and burning of tokens. As an investor, you must ensure you understand the tokenomics of the project you are interested in. Analyzing tokenomics helps you understand the demand and supply in that market. Some of the key things to look out for during this analysis include:

- Token supply.

- Distribution.

- Utility within the ecosystem.

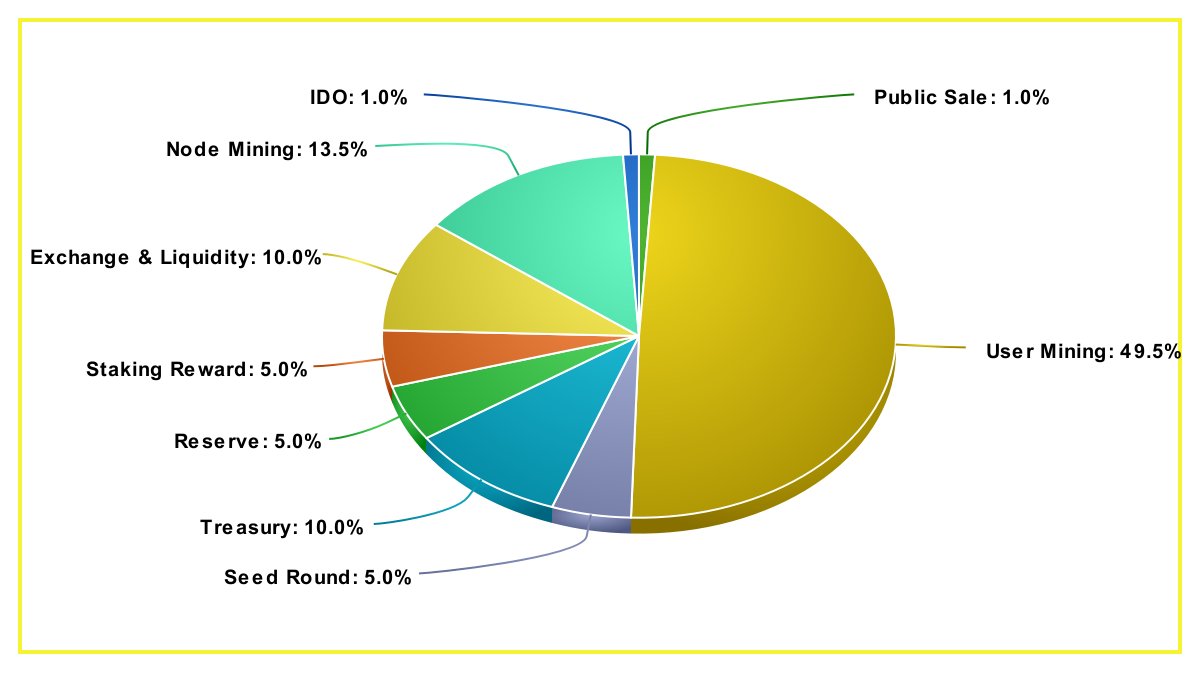

You must also find out if the project has real-world use cases that could ensure the adoption of the token. In addition, is there a provision to access some features, services, or benefits? Here is an example of a project’s tokenomics.

Let’s use the BNB token as an example. The BNB use cases include:

- Used to power the Binance Smart Chain

- Payment of fees on the exchange.

- Providing discounts on those fees.

Here are some signs that a project has good tokenomics:

- There’s utility in the ecosystem.

- It is inflation-resistant.

- It has liquidity.

- It is fairly distributed.

- It has incentives for use.

3) Read the Whitepaper and the Roadmap.

A project’s whitepaper contains all the answers or lack thereof. Reading the whitepaper helps you fully understand where the project is headed. So, the whitepaper tells you about the project’s goals, use cases, and technology.

3. Analyze the whitepaper: Read the project's whitepaper thoroughly. Look for a clear explanation of the project, its goals, roadmap, and any technical details. Evaluate if the project has a clear and realistic plan for implementation.

— Web3 Goat (@Sir_Bilyuzz) August 17, 2023

In addition, good projects often have well-detailed road maps telling you the development stages and milestones. So, when you see a new project, it is important to ask for both the whitepaper and the roadmap. Looking at these documents tells you if the project has long-term plans or not.

4) Pay Attention to the Team

The team behind a project plays a huge role in determining its success or failure. Evaluate the credibility, experiences, and expertise of the founding members and the leadership of the project. Don’t ignore a team’s track record.

For example, Do Kwon was behind the failed Basis Cash and is currently wanted for the collapse of the LUNA/Terra ecosystem.

A few questions to ask regarding the team include:

- Have they already been involved in any other reliable, successful projects?

- What are their qualifications? Are they competent?

- Do they have a good reputation in the blockchain and cryptocurrency communities?

- Have they participated in any questionable ventures or frauds?

In a case where there’s no team, the developer community is a good place to start. Ask about the project’s public GitHub. Verify the participation rates and the number of contributors. Development activity is often a good sign.

5) Are there Good Partnerships, Active Communities, and Adoption?

You can never get it wrong by asking these questions. A project with reputable partners and investors is often more reliable than one without. The logic is that partners won’t risk their reputation by being associated with a project without a prospect. Bigger partnerships mean more funding.

6️⃣ Partnerships and Collaborations

Check for partnerships with reputable companies, organizations, or institutions.

These collaborations can enhance the project's credibility and potential for adoption.

Bigger partnerships could mean more funding and more credibility. pic.twitter.com/0lJqa8foJn

— Dami-Defi (@DamiDefi) August 14, 2023

In addition, a project with dead social media pages is often a deal-breaker. Good projects have budding but active communities. Also, a project with little or no documentation is often a risk.Some other key areas to evaluate include:

- Is the project part of a market trend?

- Who are the project’s competitors, and is there a unique advantage?

- Price performance

- On-chain metrics.

In conclusion, picking crypto projects is often a tricky exercise. But, if gotten right, it could be very lucrative. However, one might incur needless losses if they invest in a poor or scam project.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.