In the recent past, many black swan events have occurred in crypto. Some examples include the collapse of Terra Luna and FTX’s bankruptcy. What followed was a prolonged bear market period. But, every cloud has a silver lining. Fast forward to October 2023, we could be seeing signs of a crypto market revival.

Today, we’ll go through 4 signs that crypto adoption is rising once again. To do this, we will be referencing the tweet here from Thor Hartvigsen.

Are We Getting Close To A Bull Market?🐂

I am more optimistic about the future of Crypto/DeFi than I've ever been.

4 charts showing that the market and crypto adoption is in a much better place than you might think👇

———————-1️⃣———————-

Ethereum +… pic.twitter.com/SSbVtGkFkl

— Thor⚡️Hartvigsen (@ThorHartvigsen) September 26, 2023

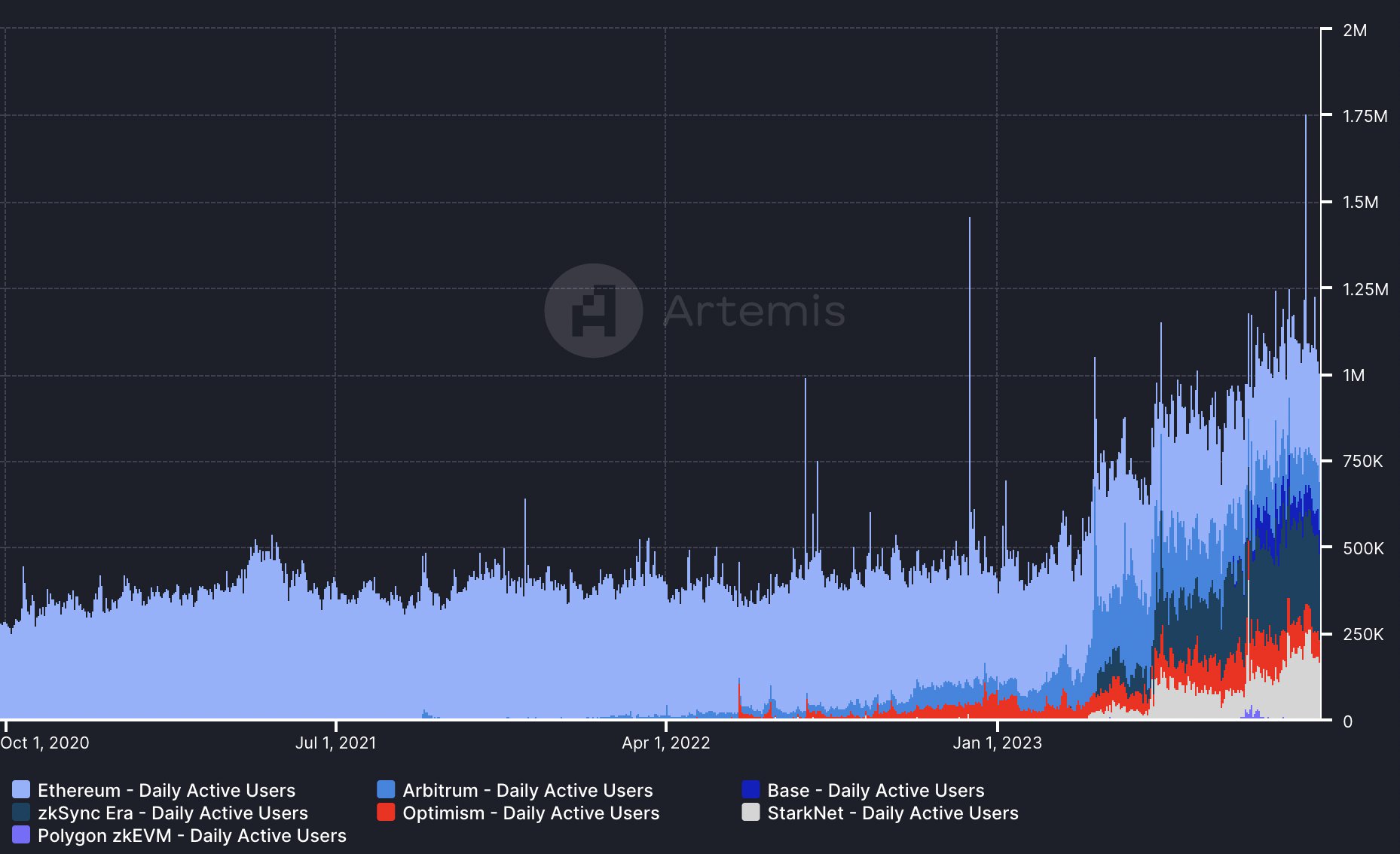

Sign #1 – An Increase in Activity on Ethereum and Its Layer 2 Projects

So, how can we conclude that crypto adoption is improving? First, we take a look at Ethereum and its Layer 2 (L2) projects. As we know, Ethereum is the chain with the highest Total Value Locked (TVL). This means it has the most active ecosystem for DeFi, NFTs, Gaming, and all things on-chain.

Hence, we can use activity on Ethereum and its L2s as a gauge for crypto adoption. In this case, we see that activity has been on a steady uptrend since October 2020. This means that more people and investors are participating in on-chain activities. Naturally, an increase in investor interest would translate to higher crypto prices.

Sign #2 – Total Stablecoin Market Cap Activity

The next clear sign of increasing crypto adoption is in stablecoin activity. Below, you can see a chart that shows the total market cap for stablecoins in the past 3 months. You can see that it has been decreasing. In general, that’s not good for crypto prices.

That’s because you need stablecoins to buy crypto. Hence, more demand for stablecoins can equate to an increase in crypto prices. And, the inverse is also true.

However, in the past month, the decrease in the stablecoin market cap has halted. Moreover, it has begun to move sideways. This means that the demand for stablecoins has stopped falling. In turn, this could be a sign that a bullish reversal is coming.

Sign #3 – Ethereum Earns USD$10 Billion in Revenue

The next clear sign of crypto adoption is in Ethereum’s revenue. Since its birth in 2015, it has grown at a fast pace. Today, it has made over USD$10 Billion in revenue.

Now, that may not seem like much. But let’s compare Ethereum with companies like Microsoft or Meta. These are industry giants in the tech space. Yet, Ethereum has achieved a USD$10 billion revenue in fewer years compared to them.

So, what does this mean? For sure, consumers are quickly catching on to Ethereum’s product. Therefore, it’s a sign that demand for $ETH and crypto could be increasing soon.

Sign #4 – Liquid Staking on Ethereum Achieves All-Time Highs

Liquid Staking starts off with a user staking a token, such as $ETH, $BNB, or $SOL. With that, he or she receives another token in return. This token is proof that represents the stake. Said token is also known as a Liquid Staking Derivative (LSD).

In 2023, the TVL within liquid staking protocols grew from $7.9 billion to $20 billion. That’s a staggering 200% increase! Amongst this $20 billion, a huge portion accrues towards the Ethereum chain. In a nutshell, this means there’s huge interest in the Ethereum ecosystem and its projects.

To learn more about the meteoric rise of LSDs, you can refer to our previous research here.

Conclusion

Aside from the above signs, there are other narratives driving crypto adoption. Since the last bull run, we’ve seen the rise of Real World Asset (RWA) projects. To add on, there are significant leaps in the ETF space for crypto too! Through ETFs, large amounts of institutional capital can flow into crypto.

The post is inspired by the chart drawn by @puntium who also states:

"The gap between perception and reality could not be larger."

Sentiment is at an all time low but real products with actual demand are getting built.

The space is moving in a healthy direction. pic.twitter.com/zLVBp7HJO9

— Thor⚡️Hartvigsen (@ThorHartvigsen) September 26, 2023

Indeed, I can not agree further with the above tweet. There’s a huge gap between sentiment and reality in the crypto space today. But, that may not be a bad thing. In my opinion, this is an opportunity for us to get some altcoin gems at low prices. To learn more about these gems, you can check out our Alpha group in the link below.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.