During the bull run of 2021, many competitors to Ethereum rose to challenge for the throne. The throne for the king of altcoins, the #2 spot on the market cap list. Projects like BNB Chain, Avalanche, and Solana are some contenders that’ve failed.

Now, you may wonder, “Why is that so?” Well, that’s because the king (Ethereum) has its generals (Layer 2 projects) that help it to scale. Today, there are many Layer 2 (L2) projects in the market built atop Ethereum. In this two-part article series, we talk about the most prominent of them all – Polygon.

What Is Polygon and How Does It Work?

Polygon is a Layer 2 solution built atop Ethereum. They are a side chain that improves Ethereum’s scalability. Moreover, Polygon also leverages on Ethereum’s security. In other words, you’ve got a more scalable network with equal security as compared to Ethereum.

Polygon is also Ethereum Virtual Machine (EVM) compatible. This means that developers can migrate their code over from Ethereum to Polygon. With this, Polygon enjoys the network effects that Ethereum has amassed.

Now, how does Polygon work with Ethereum? In a nutshell, it uses Commit Chains. Said chains are networks operating alongside Ethereum’s main chain. They batch up on-chain transactions and approve them. Then, they return the data back to Ethereum. Thus, users of the Polygon network incur less gas fees too!

2/2 🚀 Polygon's Commit Chain and scaling solutions will enhance the scalability of the Suter Shield platform and enable reduced gas fees on their product.

🔎 Protect your transaction privacy: https://t.co/MNuu0JSn97

— Polygon (@0xPolygon) June 3, 2021

In the crypto space, technology moves fast. Even in the Layer 2 space, there are always new ways to scale with Ethereum. Some of these are Optimistic rollups and ZK-rollups. Polygon is keeping abreast of these technologies as well. This is to ensure their chain remains relevant to industry and public needs.

To find out more about Polygon’s recent developments, you can check out our recent deep- dive here.

How to Be a Validator on Polygon

Simply put, a validator’s job is to confirm transactions. To start doing this, you’ll need to:

- Run a validator node.

- Lock up at least one $MATIC token as a stake.

Once you’ve done the above, you’ll do your part in securing the Polygon network.

However, the how-to for being a validator is too technical. It cannot be covered within the scope of this article. As such, we’ve included some useful links below to help you on your journey.

- Polygon’s Architecture.

- A Node Owner’s Roles and Modus Operandi.

- How to Deploy and Manage a Node.

How To Buy and Sell $MATIC

“Hey, running a node is too hard. Why don’t I just get some $MATIC tokens instead?” If that’s what’s on your mind now, then read on! We’ll go through two methods below on how to buy and sell $MATIC.

- Method #1 – Using centralized exchanges (CEXes). Examples include Binance or Kucoin.

- If you already have crypto on Binance or Kucoin, buying $MATIC is easy. Just sell your crypto into $USDT. Then, use your $USDT to buy $MATIC. You can do so through the $MATIC/$USDT trading pairs for Binance or Kucoin.

- To sell your $MATIC tokens, head over to the same $MATIC/$USDT trading pair page. Now, instead of buying, you can sell your $MATIC for $USDT instead.

Source: https://www.kucoin.com/trade/MATIC-USDT

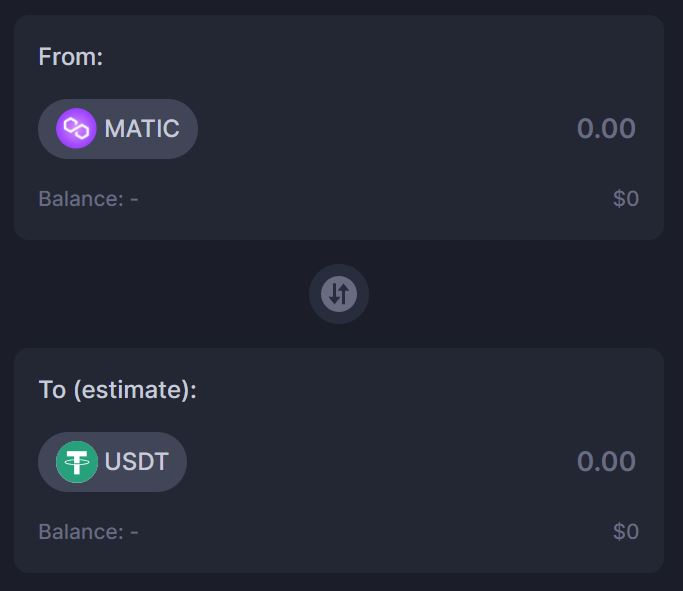

- Method #2 – Using decentralized exchanges (DEXes). Our preferred DEX would be QuickSwap.

- To use a DEX like Uniswap, you need to have $MATIC (for gas fees) and $USDT on your MetaMask or Polygon Wallet first. If you’re using MetaMask, make sure your wallet is connected to Polygon!

- Once you’ve set up the above, head over to QuickSwap and connect your wallet to the dApp.

- Finally, you can now swap out your $USDT tokens for $MATIC, or vice versa! Just input the amount of tokens you would like to buy or sell, and then approve the transactions.

Source: https://quickswap.exchange/#/swap

How and Where to Stake $MATIC?

To recap, Polygon is a proof-of-stake (PoS) blockchain. This means that its native token, $MATIC, can be staked. By staking, you can earn a healthy return while securing the network too! With this, your $MATIC doesn’t sit idle in its wallet.

There are a few ways you can stake your $MATIC. Let’s start off with the easiest way.

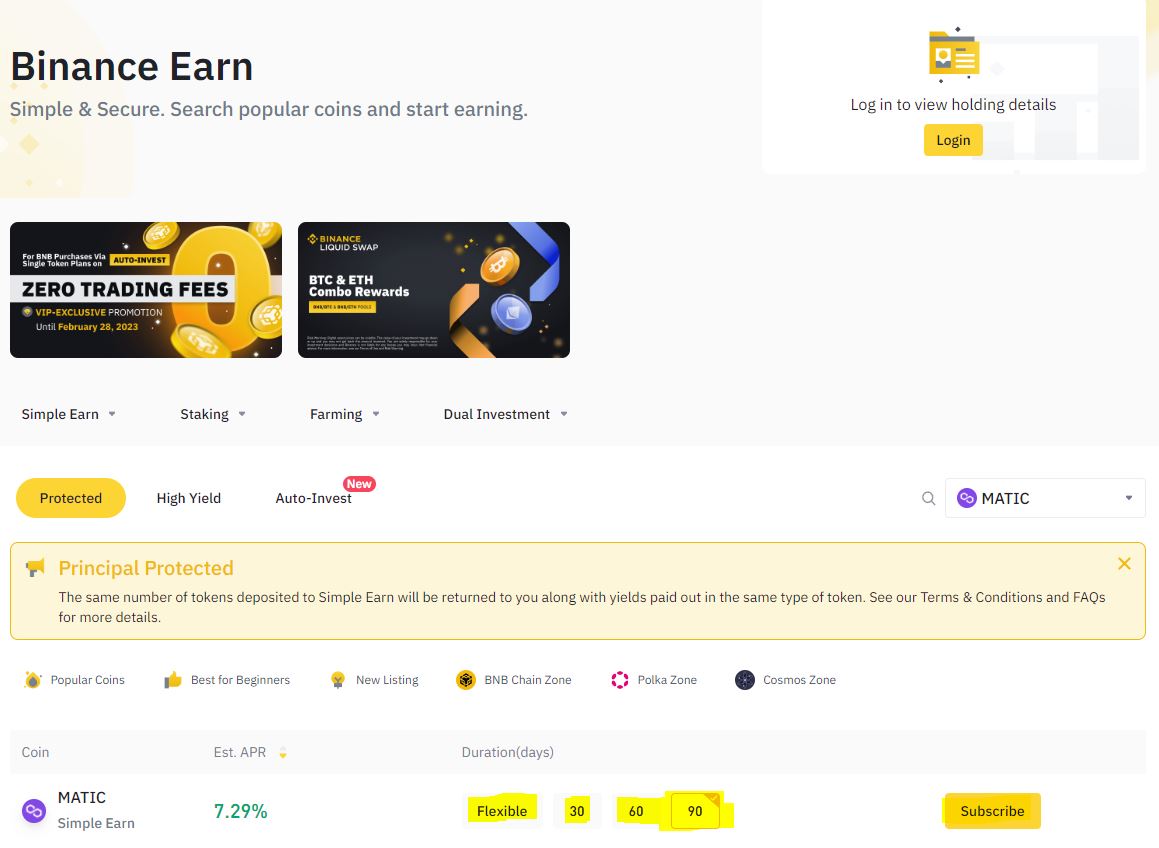

Binance Staking

A hassle-free way of staking would be to stake with a good CEX. For this, we would recommend Binance Staking. To start off:

- Head on over to the Binance Earn page.

- Choose the period for your $MATIC staking. The longer you commit, the higher your return.

- Click on “Subscribe” and voila! You’re now a proud staker of $MATIC.

Now, let’s move on to the next method.

Polygon Wallet Staking

If you hold your $MATIC tokens on the Polygon Wallet, then this method is for you! Simply follow the last section of this article here. You’ll be able to stake your $MATIC. However, do note that you’ll stake an ERC20 version of $MATIC on Ethereum chain using this method.

Liquid Staking on Lido Finance

Lastly, let’s look at liquid staking for $MATIC. This option is best for you if you use a MetaMask wallet.

You can stake your $MATIC on Lido Finance. In turn, you receive an equivalent amount of $stMATIC, which represents your stake. This allows your staked capital to be liquid as well. Hence the term “liquid staking.”

What is @LidoFinance?

With around ~$9B staked, across multiple chains, Lido builds state of the art liquid staking protocols to grow the staking economy.

[2/6]

— Polygon (@0xPolygon) May 16, 2022

For a detailed guide to Lido and liquid staking, you can check out our previous research here. To start staking with Lido, you’ve to:

- Head over to their Polygon Staking page.

- Connect your MetaMask wallet.

- Input the amount of $MATIC you would like to stake.

- Click on “Stake Now.”

Congratulations! You’ve now staked your $MATIC tokens with Lido. Remember to check that you’ve received some $stMATIC tokens in return!

Conclusion

We hope you’ve enjoyed part one of this article series! Today, we’ve gone through what Polygon is and how it works. Also, we dove into what it takes to be a validator, as well as how to transact and stake $MATIC.

If you’d like to find out more, read our Part 2 article on Polygon.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.